Over the past four years, we’ve documented the strategic transformation of upstream oil and gas producers from growth at all costs to the fiscally conservative concentration on accumulating free cash flow to accelerate shareholder returns. Much like their upstream counterparts, midstream corporations and master limited partnerships (MLPs) have shifted to fiscal conservatism, focusing less on growth and capital investment and more on shareholder returns, acquisitions and debt reduction. In today’s RBN blog, we examine the cash flow allocation of a representative baker’s dozen of midstream companies as they compete for investor support.

Taking advantage of the more stable, fee-based revenues from energy infrastructure such as pipelines, gas processing plants, storage facilities and fractionators, midstream entities historically have focused on generating substantial returns to shareholders. In the early 1980s, midstream MLPs were created as tax-efficient entities that aimed to distribute most of their cash flow to their general and limited partners. The primary benefit of MLPs was single taxation, which meant that taxes were not paid on the entity level but instead were passed through to the limited partners’ personal tax returns. A portion of those distributions qualified as return of capital, which meant the taxes on that portion could be deferred until the units were sold. In contrast, a corporation’s income is subject to double taxation, once at the corporate level and then again on dividends at the shareholder level.

However, in the early years of the Shale Era midstream companies transitioned their strategies toward growth as they developed U.S. gathering systems, “replumbed” long-haul pipelines and made other investments to accommodate the needs of new unconventional oil and gas plays. They largely funded this investment by issuing new units, but the oil price crash in 2014-15 crimped access to capital markets. MLPs were particularly impacted because up to half of their cash flows were syphoned off to general partners as incentive distribution rights (IDRs), which award a general partner a greater share of the MLP’s profits as certain goals are met. Although the general partnership normally holds only a 2% limited partnership interest, IDRs can range to up to 50% of the total distributions, sharply reducing cash available for investment and limited partner distributions. In addition, because regulations severely limit retirement accounts and pension funds from purchasing their limited partnership units, the universe of potential investors is sharply reduced. As a result, many companies slashed or froze distributions. Then the Tax Reform Act of 2017 cut the corporate tax rate, reducing the impact of double taxation. As a result, several major midstream entities restructured as traditional C-corps and many remaining MLPs restricted or eliminated IDRs.

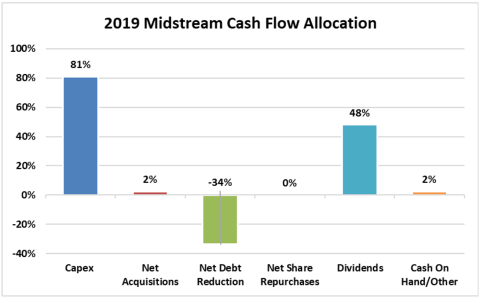

Figure 1. 2019 Midstream Company Cash Flow Allocation.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article