Mont Belvieu, TX and Conway, KS, are the two most significant U.S. hubs for NGL trading, storage and fractionation, with the much bigger Mont Belvieu hub primarily serving Gulf Coast and export demand, while the smaller Conway hub is focused on Midwest/Great Plains demand, especially for propane. The pricing dynamics between the two hubs are a key indicator of the supply/demand balance between the regions, but they don’t have the same kind of influence over the direction or magnitude of flows as price differential dynamics often do for other energy commodities. In today’s RBN blog, we will examine the gap between the price of the NGL “basket” in Mont Belvieu versus Conway and what that price spread tells us.

We should begin with a brief reminder for readers who don’t live and breathe NGLs. The NGL market is in some ways a world of its own, with more quirks and idiosyncrasies than the crude oil and natural gas markets combined. NGLs are, of course, produced in significant volumes in most Lower 48 production areas, with notable exceptions such as the Haynesville and parts of the Marcellus where hydrocarbon output is largely limited to dry gas with little or no liquids. The associated gas emerging from wells with crude oil includes a combination of natural gas, mixed NGLs and impurities that are separated at gas processing plants into natural gas and mixed NGLs (aka Y-grade), each of which is then moved to downstream customers. Depending on the region and pricing relationships, some of the ethane within the associated gas is “rejected” into natural gas at the processing plant.

The Y-grade NGLs are either fractionated into so-called purity products (ethane, propane, normal butane, isobutane and natural gasoline) locally (such as in the Marcellus/Utica) or piped as Y-grade long-distance to NGL hubs like Mont Belvieu or Conway, where the mixed NGLs are stored and fractionated, with the resulting purity products then forwarded — like crude oil and natural gas — to downstream customers.

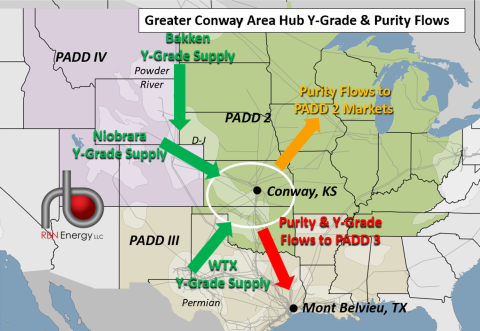

Data from the Energy Information Administration (EIA), which tracks NGL flows between PADDs, helps to explain Y-grade flows to both the “greater Conway area” and Mont Belvieu (see We’re Not In Kansas Anymore). We’ll start with Conway, which receives mixed NGLs from a variety of sources, including the Bakken, the Rockies, and West Texas — as we’ll get to in a moment, some of that Y-grade is fractionated in Conway and some passes through the hub on its way to Mont Belvieu.

Before getting into the nitty gritty, let’s take a moment to define what we mean by the “greater Conway area.” Conway is a real place, a tiny Kansas town of about 1,100 folks just west of McPherson. The Conway-McPherson area is an NGL storage hub that also has fractionation capacity. Index prices are quoted by price reporting agencies (PRAs) like OPIS for that hub. However, the balance in what we call the greater Conway area, which essentially includes all of Kansas and Oklahoma, is what the market generally considers “Conway,” with the NGL supply/demand balance in the area having a direct impact on prices reported for the Conway hub. This includes production in Kansas and Oklahoma, fractionation capacity in Conway, and demand for purity products in the northern and eastern parts of PADD 2 (Midwest/Great Plains). For the purposes of this blog, we will be discussing the greater Conway area rather than the specific hub at Conway.

Figure 1 below helps illustrate NGL flows into and out of Conway. According to EIA, about 1,170 Mb/d of NGLs was piped to or through Conway in 2023, about 18% of total U.S. volumes (green arrows).

Figure 1. Greater Conway NGL Hub Y-Grade & Purity Flows. Source: RBN

Join Backstage Pass to Read Full Article