Many have argued that U.S.-sourced LNG can be instrumental in combating climate change by helping countries around the world replace coal-fired generation with natural gas-fired power. While this argument carries a lot of force in the eyes of many politicians and LNG marketers, the questions of exactly how — and to what extent — LNG can replace coal need to be asked. In today’s RBN blog, we’ll look at the challenges that the expanded use of LNG faces in countries with high coal utilization and the possible means of overcoming them.

The challenges inherent in the world’s ongoing shift to a lower-carbon economy are social, political and economic — not to mention practical — which in the aggregate make the path toward decarbonization via expanded LNG use a tortuous one. As we said recently in Hello Darkness, My Old Friend, there is a potential disconnect in the amount of LNG supply coming online by the end of the decade and demand. The ongoing use of coal can be seen as both a headwind and a tailwind for LNG. On one hand, LNG has long been viewed as a more environmentally friendly alternative to coal that could be prioritized by governments looking to decarbonize. On the other hand, coal-fired power is cheap and the fleets of several growing countries have expanded recently. The focus of today’s blog is on countries such as China, India, South Africa and Indonesia (see Figure 1 below), each of which are major economies where coal is used extensively for power generation — and where its replacement would require massive volumes of LNG imports.

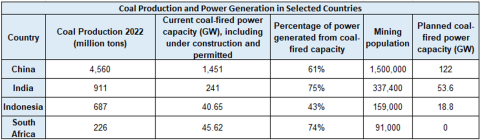

Figure 1. Coal Production and Power Generation in Selected Countries. Source: Global Energy Mine Tracker

There are several economic reasons why a switch from coal to LNG would be challenging, but the political aspects are worth mentioning at the start. In the four countries noted above, there are strong and deeply embedded coal lobbies that view gas-fired power generation and LNG imports as threats to a status quo that has benefited coal companies for decades. Take China as an example. As noted in Figure 1, the country produced 4.56 billion metric tons (MT) of coal in 2022 and employs 1.5 million people in the coal mining industry, more than half the global total of 2.7 million. Moreover, China in 2022 alone proposed construction of another 122 GW of coal-fired power, with the prospect of having 200 GW of new capacity online by 2030. But whether it’s China, India or any other coal-friendly country, a large-scale move away from coal-fired power generation needs to address how to create a future for large numbers of mining workers and their communities and address established business structures that benefit from the way things are.

Join Backstage Pass to Read Full Article