Listen to Paul Simon’s “The Sound of Silence” and you hear the words of a teenager coming to terms with the disconnect between the world his parents promised and the real world yet to come. In the LNG market, there’s a similar generational divide. A business built on long-term contracts, rigid trade patterns, and the promise of substantial growth potential is being met with a more skeptical outlook, one in which a large amount of incremental LNG supply has been locked up but serious questions remain about LNG demand. As we discuss in today’s RBN blog, an entire generation of LNG supply is being built on the presumption of selling it for $10/MMBtu or more, but a shortfall in demand growth could leave it selling for considerably less. And if that happens … sunk-cost economics, here we come.

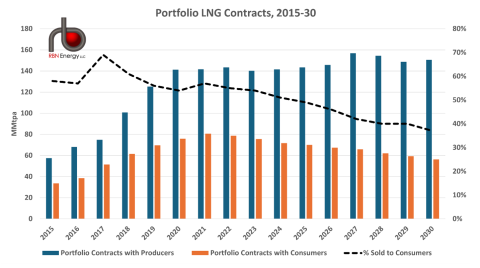

The enormous amount of LNG supply coming into the market in the mid-to-late 2020s is looking for long-term buyers … and looking and looking and looking. Not to get all existential, but the outlook for LNG demand is increasingly taking on the overtones of “Waiting for Godot,” the Samuel Beckett play: It’s out there, it’s coming, and it’s only a matter of time until it arrives. But like Godot, the consumers for all that LNG expected to come online in the next several years may prove elusive. The disconnect can be viewed through the lens of those who have contracted for LNG volumes. Although LNG portfolio contracts with producers (blue bars in Figure 1 below) are projected to climb from 141 million metric tons per annum (MMtpa) in 2024 to more than 150 MMtpa by 2030, the amount actually committed to consumers (orange bars) falls from 51% to 37% (dashed black line) over the same period. Part of this dichotomy may be attributable to the differing strategies of LNG portfolio players and gas consumers, with the former, up to this point, willing to accept the risk to lock in supply and global access while the latter, uncertain about their future needs, has been more inclined to cut shorter-term supply deals.

Figure 1. Portfolio LNG Contracts, 2015-30. Source: GIIGNL

Join Backstage Pass to Read Full Article