The hopes of Marcellus gas suppliers to move more of their product east are playing out in very different ways in metropolitan New York City and in New England. New pipelines to deliver gas from Pennsylvania, West Virginia and Ohio to the Big Apple and its environs already are installed and operating, easing the metro area’s supply crunch and shrinking regional price “basis”. But plans to expand gas-transmission capacity to New England are stalled, and some gas users there are facing another potentially supply-constrained expensive winter. Today we begin a new series looking at why—for the foreseeable future at least--it’s better to be a gas user in New York City than Boston.

More than a year ago, we used a quip from New York Yankee quote-master Yogi Berra as the title of our ”Déjà Vu All Over Again—Northeast Natural Gas, Pipelines and Big Decisions” blog explaining why gas from the Marcellus play would over time displace supplies from the Gulf Coast throughout the Northeast. However, as we emphasized then and repeat now, the speed of that supply shift depends in large part on the ability of pipeline companies to build new capacity to move Marcellus gas east to major population centers on the eastern seaboard, including New York City, and New England.

Since November (2013) several major pipeline projects serving northern New Jersey and New York City have become operational, together providing a roughly one-third increase in the volume of Marcellus and other gas that can be delivered to the metro area. And it’s the supply from Marcellus that opened up the most.

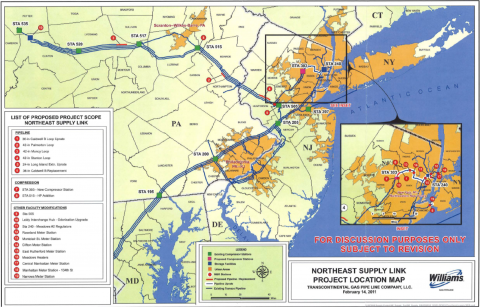

First, Williams Partners LP on November 1 placed into service the remaining 125,000 dth/d of capacity added by its $390 million Northeast Supply Link. (The first 125,000 dth/d of capacity came online in August, three months ahead of schedule.) The project, an expansion of Williams’ Transco mainline and Leidy systems, represented the first major expansion of the Transco pipeline designed specifically to connect Marcellus gas and northeastern markets (see Figure 1). It included about 12 miles of 42-inch-diameter pipeline in new “loops” in Pennsylvania’s Lycoming and Monroe counties and in Hunterdon County, New Jersey; the project also included 26 miles of pipeline upgrades, and new or upgraded compression stations. (As you may recall from previous blogs, a pipeline “loop” is a segment of pipeline installed adjacent to an existing pipeline and connected to the existing pipeline at both ends.)

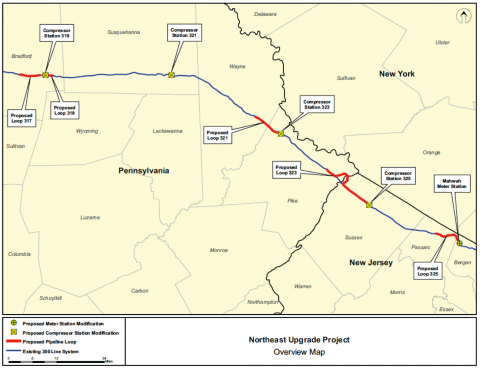

Next, there was Kinder Morgan’s $500 million Tennessee Northeast Upgrade project (see Figure 2). Kinder Morgan on November 1 added 636 M dth/d of capacity to the Tennessee Gas Pipeline’s (TGP) 24-inch-diameter 300 Line by adding five, 30-inch-diameter pipeline loops and modifying four existing compression stations. These five loops closed out the remaining unlooped segments of TGP’s existing 300 Line east of Bradford County, Pennsylvania into New Jersey. Chesapeake Energy Marketing and Statoil Natural Gas hold the rights to move gas through the expansion.

Figure 2

Source: Kinder Morgan (Click to Enlarge)

The most costly of the just-finished projects--Spectra Energy’s $1.2 billion New Jersey-New York expansion also came online November 1. The expansion of the Texas Eastern Transmission Co. (TETCO) and Algonquin Gas Transmission pipelines--which involved a 16-mile extension of TETCO’s existing Staten Island line to lower Manhattan, and the replacement of five miles of existing pipeline in New Jersey and New York with larger-diameter pipe (see Figure 3)—boosted the capacity of gas deliveries to New York City by up to 800 MMcf/d. Another way to put it is, the project roughly doubled the amount of gas that can make its way to the heart of the nation’s largest city. Again, Chesapeake Energy Marketing and Statoil Natural Gas hold the rights to move gas through the expansion.

Join Backstage Pass to Read Full Article