We’ve reached the two-year anniversary of the reversal of the joint-venture Capline crude oil pipeline. With its current north-to-south flow, it adds to the few conduits that can move oil from the Midwest to the Gulf Coast, specifically the St. James, LA, oil hub. Flows have been on a steady climb since southbound service began in December 2021, but volumes appear to be short of its available capacity, and there are looming headwinds. In today’s RBN blog, we examine whether Capline’s flows could be affected by the impending startup of the Canadian government-owned Trans Mountain Expansion Project (TMX). Could rising Alberta production be its golden ticket?

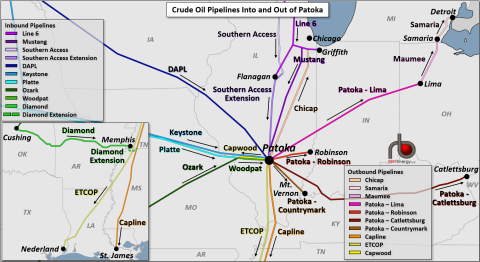

The 632-mile Capline system (dark-orange line in Figure 1 below) moved as much as 1.2 MMb/d of imported crude and offshore Gulf of Mexico output to Midwestern refiners in the decades after it began service in 1968. But those volumes started to decline as refineries in the Midwest gained more access to barrels from Western Canada and the Bakken, as we analyzed in Draggin’ the Capline and later in Livin’ on the Edge. Flows on the 40-inch-diameter pipeline took another hit after Plains All American and Valero Energy’s Diamond Pipeline (green line in Figure 1 inset) from the Cushing, OK, storage hub to Valero’s Memphis, TN, refinery started up in 2017, eliminating the need to bring barrels up from St. James, a matter we examined in Memphis, Tennessee.

Figure 1. Crude Oil Pipelines Into and Out of Patoka, IL. Source: RBN

Join Backstage Pass to Read Full Article