Western Canada’s natural gas market never really seems to catch a break. Prices this winter have remained well below those across much of the rest of North America thanks to an all-too-common combination of insufficient pipeline export capacity from the region, bloated gas storage and robust supply growth. Even with forward price prospects for much of the rest of the continent looking buoyant, with more gas expected to head to expanding Gulf Coast LNG terminals and a storage-refill season that will be stronger than last year, price upside for Western Canada looks to be minimal at best and will be partly dependent on the rate of gas intake to LNG Canada, as we explain in today’s RBN blog.

We all love those movies about the wrongly convicted individual sent to prison, only to be released (or escaping!) later thanks to a combination of legal work, tenacity and plain stubbornness in overcoming the unjust imprisonment. Western Canada’s gas producers were probably hoping that this most recent winter heating season might provide a similar storyline for its primary price marker, AECO, and its regional cousin, Station 2, which have been imprisoned inside Western Canada’s all-too-often pipeline-constrained and oversupplied regional market, with prices that have frequently disconnected from pricing action elsewhere in North America.

[It’s a compelling time to consider U.S. and Canadian hydrocarbon markets. As North America’s energy landscape continues to evolve, understanding the forces shaping crude, natural gas, and NGL markets has never been more critical. That’s why this year, RBN is heading north in this special School of Energy Canada session, set for August 26-27 in Calgary. Join us as we break down the latest market trends, production shifts, and infrastructure developments—giving you the insights you need to navigate the fast-changing energy sector on both sides of the border. Register today and save $500 with our Early Bird Rate. Click here for more information on School of Energy Canada.]

Hopes were high at the start of the heating season in November that the right combination of colder weather (and the strong demand to go with it), a healthy drawdown of bloated regional gas storage, some self-imposed production constraints, modest growth in pipeline egress capacity from the region and, importantly, a gradual ramping up of gas supply into LNG Canada, would do the trick and unlock the door to the outside world with a better connection to higher gas prices across the continent. That was a long list, and everything had to go just right to pull off that escape.

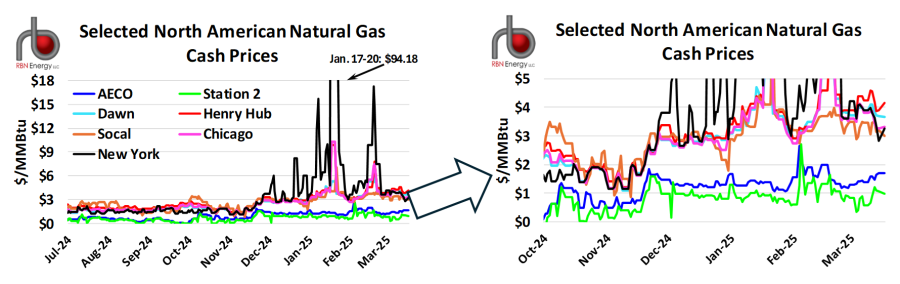

Well, it didn’t quite pan out as hoped. AECO (blue line in Figure 1 charts below) and Station 2 (green line) cash prices this past winter have been locked away in the market’s dungeon the entire heating season. Gas cash prices in many other regional markets (compare to red, orange, pink and black lines) were already trending upward at the start of the heating season and then soared on the arrival of colder-than-average weather and storms across parts of Canada and the U.S. in mid-January, which was followed by another round of colder-than-average temperatures for most of North America for most of February and a second price surge. No matter where you looked, cash prices elsewhere reacted as space heating demand cranked up, and immense storage withdrawals followed to keep regional markets adequately supplied. Even Canada’s other major cash price marker of Dawn (light-blue line) in southern Ontario —closest to Canada’s major population centers in the east and large U.S. centers in the Midwest and Northeast — ramped up to much higher levels this winter and has held there since.

Figure 1. Selected North American Natural Gas Cash Prices. Source: Bloomberg

Join Backstage Pass to Read Full Article