For most of us, matching spending with income is the logical path to financial stability. However, after decades of aggressive investment in search of growth, the “dollars in equals dollars out” method of allocating free cash flow has been an adjustment for many U.S. oil and gas producers. Their post-pandemic concentration on keeping capital spending well below inflows, maintaining healthy leverage ratios and directing excess funds to reward shareholders with dividends and stock buybacks has revitalized the industry and restored investor confidence. But ebbing commodity prices have upped the difficulty of this quarterly zero-sum game. In today’s RBN blog, we will analyze the shifts detected in Q2 2025 cash allocation of the 38 major U.S. E&Ps we cover.

As we explained earlier this summer in Mission: Impossible, higher free cash flows from increased commodity prices allowed producers to boost dividends and maintain an elevated level of share repurchases in Q1 2025. Producers funded a hefty $4.6 billion in net acquisition spending while cutting capital investment budgets by 4% to a near-term low 56% of free cash flow. Our universe of E&Ps maintained modest debt repayment and added $376 million to its cash balances.

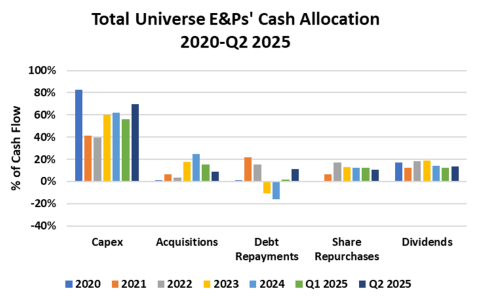

However, as recently outlined in Wrong Road Again, commodity prices retreated sharply in Q2 2025. The E&P companies we track generated $25.5 billion in cash flow from operations (CFOA), down 12% from $28.9 billion in the prior quarter. Organic capital investment totaled $17.8 billion, yielding a 70% reinvestment rate (dark-blue bar in Capex grouping in Figure 1 below), a five-year high, and generated $7.7 billion in free cash flow (FCF), down from $12.9 billion in Q1 2025. In response, producers slashed Q2 2025 net acquisition spending to $2.2 billion, or 9% of CFOA (dark-blue bar in Acquisition grouping), less than half the acquisition outlays in Q1 2025 (green bar). Share repurchases continued their slide, falling to 10% of CFOA in Q2 2025 (dark-blue bar in Share Repurchases grouping), down from the peak of 17% in 2022 (gray bar). The approximately $2.5 billion in lower M&A spending and $1 billion shaved off buybacks largely offset the decline in CFOA.

Figure 1. E&P Cash Allocation, 2020-Q2 2025.

Source: Oil & Gas Financial Analytics, LLC

One key decision made by producers was to sustain the level of dividend payments as best they could quarter over quarter, despite the lower commodity realizations. And to that end, the cash allocated to dividends was only $100 million lower at $3.5 billion in Q2 2025. A second key decision by E&P managements involved the critical issue of maintaining solid balance sheets in the face of declining cash flows. While some companies dipped modestly into their credit lines to fund acquisitions over the last two years, management decided to draw the line in Q2 2025. Net debt repayments accelerated as $2.2 billion was paid down in Q2 2025; that equaled 11% of CFOA (dark-blue bar in Debt Repayments grouping), far above the amount paid off in Q1 2025 (green bar). As a result, the average debt-to-capital ratio dipped to a five-year-low 24.5% in Q2 2025 (blue bar to far right in Figure 2 below) from a high near 40% in 2020.

Join Backstage Pass to Read Full Article