U.S. interstates are populated with electronic displays that update drivers in real-time on traffic conditions, road closures, weather alerts and other important events. If there was a sign for executives steering our nation’s oil and gas producers, it would likely read “Poor Visibility, Slow Down Ahead.” After a short-lived price rally in Q1 2025, the industry faced lower commodity realizations and macroeconomic headwinds in Q2 2025, which spooked investors and hardened a cautious investment approach. In today’s RBN blog, we analyze the latest results of the 39 major U.S. E&P companies we cover and look at what’s ahead.

After steady quarterly earnings declines since 2022, E&P profits rose 37% to $14.96/boe in Q1 2025, driven by a strong January crude oil spot price of $75.74/bbl and a 70% quarter-over-quarter growth in natural gas realizations. However, oil prices slipped to the $62-$63/bbl range in April and May before rising in June, while natural gas returns weakened throughout the quarter. Anticipating a negative impact on Q2 2025 results, the S&P E&P Index fell 15% in April to a four-year low and the energy sector generated the lowest overall Q2 2025 performance of any sector in the S&P 500.

Growing pessimism and uncertainty on the part of E&P managements was also reflected in the Q2 2025 survey of 91 oil and gas producers conducted by the Federal Reserve Bank of Dallas and published on July 2, just before the release of individual company results. The bank’s business activity index, the broadest measure of conditions faced by companies in a wide swath of the shale patch in Texas and New Mexico, turned negative for the first time since mid-2020. Executives cited heightened uncertainty from OPEC+’s unwinding of production cuts, trade and tariff changes, and escalating geopolitical tensions that are contributing to commodity price volatility and higher operating and capital costs. The survey indicated future production and investment would trend lower.

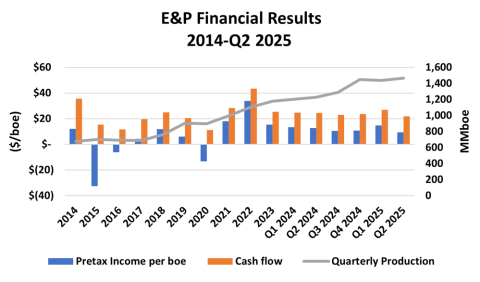

Figure 1. E&P Financial Results and Production, 2014-Q2 2025.

Source: Oil & Gas Financial Analytics LLC

In upcoming blogs, we will analyze the cash-flow allocations and future production and investment forecasts disclosed in the midyear releases and conference calls. In today’s blog, we can report that the pessimism was certainly justified by the Q2 2025 financial results of the 39 E&Ps we cover. Pre-tax operating earnings fell 36% to $9.48/boe (blue bar at far right and left axis in Figure 1 above) and pre-tax operating cash flow (orange bar at far right and left axis) declined 19% to $21.74/boe. Realized prices were 14% lower at $33.03/boe, while total expenses were down 1% to $23.55/boe, led by a 2% decline in lifting costs. Impairment charges were down 5% but were mostly concentrated in the Oil-Weighted E&P peer group. DD&A expenses were up 2%, while exploration expenses increased 6%. Oil and gas production (gray line and right axis) was up 2% to 1.467 billion boe.

Join Backstage Pass to Read Full Article