Crude oil producers in the prolific Permian Basin have plenty of options to move their barrels, especially since pipeline capacity currently exceeds production, but not every route out of the basin is equal. One of the hottest destinations for Permian crude is Houston, which boasts an attractive mix of refining and export demand. In today’s RBN blog, we look at the pipelines that transport Permian crude to Houston, discuss why it’s such a vital spot, and preview our latest Drill Down Report.

The Permian produces about 6.6 MMb/d of crude oil today, most of it destined for the U.S. Gulf Coast. The Houston and Corpus Christi areas are in a tight race for those barrels, competing head-to-head to attract the largest flows. Corpus Christi surpassed Houston as the top dog in Q1 2025, with Permian-to-Corpus flows averaging 2.5 MMb/d compared to Houston’s 2.4 MMb/d, according to RBN’s Crude Oil Permian Weekly report. (In 2024, Houston outpaced Corpus for half of the months.) Combined, they account for about three-quarters of Permian output.

Permian barrels also reach the Cushing, OK, storage hub as well as the Louisiana and Nederland, TX, markets. Further, a smaller portion is refined locally in West Texas, New Mexico and Oklahoma. Key refineries at the heart of the region include Marathon Petroleum’s El Paso, TX, refinery (133 Mb/d); HF Sinclair’s Navajo refinery (100 Mb/d) in Artesia, NM; and Delek US’s Big Spring, TX, refinery (73 Mb/d). Phillips 66’s Borger, TX, refinery (149 Mb/d) and Valero Energy’s Ardmore, OK, refinery (90 Mb/d) also consume Permian barrels.

Houston is considered an excellent option for Permian crude, with its network of pipelines connecting the basin to refineries, storage facilities and export terminals — thereby providing a high degree of market optionality. Unlike Corpus Christi, which has a few refineries but is predominantly an export market, Houston has a more balanced split between refineries and exports (more on this below). Houston is a large refining center, with about 2.35 MMb/d of crude processing capacity, and year-to-date exports from Houston-area terminals, according to our Crude Voyager Report, have averaged 1.1 MMb/d.

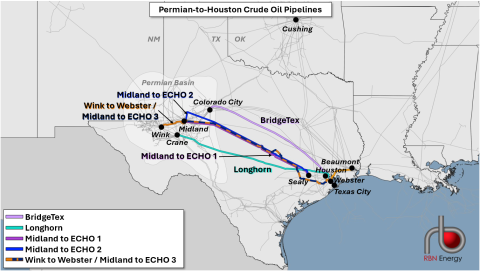

Figure 1. Permian-to-Houston Crude Oil Pipelines. Source: RBN

Join Backstage Pass to Read Full Article