The details of a trade deal between the U.S. and China, announced June 26 by Commerce Secretary Howard Lutnick and confirmed by China, remain sparse. Once they are finalized, the requirement for U.S. exporters to obtain a Bureau of Industry and Security (BIS) license to send ethane to China should be lifted, but the effect on trade flows is already apparent. In today’s RBN blog, we review the impact of the BIS license requirement, the still-pending imposition of fees on vessels owned or operated by China, and the risk that comes with using the energy industry as a bargaining chip in trade talks.

Let’s look at the impact of the requirement for export licenses to start. Enterprise Products announced May 29 that it had received a notice from the BIS stating that ethane exports to China posed an “unacceptable risk of use or diversion to a military end use” and that they would require specific licenses per cargo in order to be delivered. Energy Transfer said in a filing with the Securities and Exchange Commission (SEC) on June 3 that it had received a similar letter. (For more on the impact of the BIS licenses, see Hey, Hey, What Can I Do and Whatcha Gonna Do When C2 Says Goodbye.)

It looked like the industry was going to dodge a big bullet when, on June 10, China and the U.S. reached a tentative agreement aimed at defusing the latest round of trade tensions between the two countries. According to reports, the agreement included revised tariff rates, a six-month relaxation of Chinese export license requirements for rare-earth elements (especially magnets) and a reciprocal easing of U.S. export restrictions on semiconductor technology. Dropping the BIS license requirement for ethane was also part of the deal, although the initial announcement did not lead the BIS to start issuing licenses. As of June 27, that agreement appears to have been signed, although licenses have not yet been granted for ethane exports to China. Reuters reported June 25 that companies will be allowed to load ships and send them to China, just not unload them, a potential indication that the license requirement may be coming to an end. Satellite Chemical USA and Vinmar both received letters last week allowing them to load vessels bound for China but denying them the ability to unload without permission.

The Trump administration has increasingly used U.S. energy — especially commitments to purchase U.S.-sourced LNG — as an element in trade negotiations (see Road to Alaska), and it appears to have used the withholding of ethane as a cudgel during talks with China in a way that it hasn’t before (more on that in a bit). The impact of the license requirement can be clearly seen in the export data.

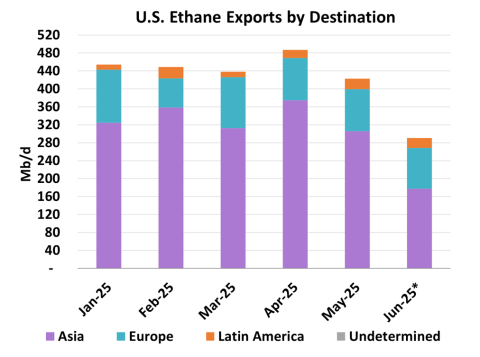

With the negotiations between the U.S. and China continuing in June, U.S. ethane exports slowed significantly. Figure 1 below shows U.S. ethane exports by stated destination for January through the first half of June, with the vast majority headed to Asia (purple bar sections), followed by Europe (teal bar sections) and Latin America (orange bar sections). It’s important to note that the destination is what’s indicated by ship-tracking data and may not be the actual final destination, as most of the vessels that departed in June and were headed to Asia have not arrived yet. In addition, there are ethane vessels in the Gulf that are laden and awaiting orders. According to Kpler data, there are at least three laden ethane vessels sailing in circles off the coast of China. What’s important, however, is that at least for the first half of June, exports were down to around 280 Mb/d from the previous peak in April of more than 480 Mb/d. When they left the port, about 180 Mb/d of the ethane was slated to go to Asia. Some of those vessels will be headed toward India, but volumes “headed” to China will not be allowed to unload there — at least not yet. If the barrels are unable to be unloaded, the nature of the ethane market means that most of these U.S. volumes will not find a home outside of China, and China will not be able to source its ethane from elsewhere.

Figure 1: Ethane Exports by Destination. Source: RBN

* Data is for first half of June

Join Backstage Pass to Read Full Article