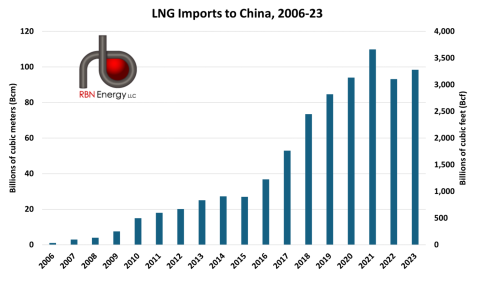

China regained its place as the world’s largest LNG importer in 2023, a title it lost in 2022 due to COVID-related shutdowns. Given that China only started importing LNG in 2006, the country’s demand growth — imports last year totaled 71.3 million metric tons (~9.5 Bcf/d), just under 18% of globally traded demand — can only be described as spectacular. But this unprecedented growth story is undergoing fundamental changes which are likely to result in major impacts to LNG commerce not only in China but in the Far East and possibly beyond. In today’s RBN blog, we look at some of these changes and ask how the Big Three national oil companies (NOCs) — CNOOC, PetroChina and Sinopec — could change their business models as smaller provincial gas utility buyers pursue their own LNG imports.

Before we look closer at the development of LNG commerce in China we should emphasize that, from an LNG import perspective, China is not a unified energy-consuming market but an aggregate of nine individual coastal provincial markets that are not well linked by pipelines, meaning that each has a different market composition and demand profile. Consequently, understanding and characterizing Chinese LNG demand presents a number of challenges. We should also note that China imports large volumes of pipeline gas and has domestic gas supplies from both offshore and onshore sources, including a burgeoning shale gas development program.

LNG imports to China have been dominated by the Big Three since imports commenced to the Guangdong Dapeng LNG terminal in 2006, the same year China’s imports began to surge (see Figure 1 below). The initiative was led by CNOOC and followed by PetroChina, with Sinopec being the last to join the party in 2016. These companies have been instrumental in constructing and supplying product to more than 20 LNG import facilities in China. This was done by creating joint ventures (JVs) to handle LNG imports in which regional gas distributors and provincial governments held equity interests, although LNG purchases and control of the terminals were managed by the Big Three, who acted as market gatekeepers.

Figure 1. LNG Imports to China, 2006-23.

Sources: Statistical Review of World Energy, Center on Global Energy Policy

Join Backstage Pass to Read Full Article