Last week our attention was drawn to the “State of Energy” report published by the Texas Independent Producers and Royalty Owners (TIPRO). Using Bureau of Labor quarterly census data the report provides a summary of state and national benefits attributed to growing US oil and gas production during 2012. For example, TIPRO reports that oil and gas industry employment increased by 65,000 to 971,000 in 2012. But the benefits of increased production are not just confined to the oil and gas industry. According to a presentation by the Chamber of Commerce Institute for 21st Century Energy (ITCE) the shale revolution provided $237B of growth to the US economy in 2012. Today we look at how huge changes taking place in US energy supplies impact the wider economy.

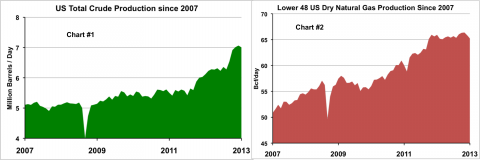

Oil and gas industry growth in the US over the past 5 years has largely been driven by increased domestic production from what we generically call shale (includes tight gas, tight oil and all manner of unconventional production). Today US production of natural gas and natural gas liquids (NGLs) are at all time record highs and crude oil production is headed back to levels not seen since the early 1980s. The two charts below illustrate the growth in daily US crude oil and natural gas production since 2007. Chart #1 shows Energy Information Administration (EIA) estimates of monthly US total crude oil production increasing by 0.9 MMb/d between January 2007 and December 2011 and then by another 1 MMb/d to 7 MMb/d during 2012. Chart #2 shows EIA estimates for lower-48 natural gas production increasing by 15 Bcf/d from 50.8 Bcf/d in January 2007 to 65.8 Bcf/d in December 2012. Over the same time period US NGL gas plant production increased 44 percent from 1.7 MMb/d to 2.4 MMb/d.

Source: EIA (Click to Enlarge)

Increased oil and gas production has brought with it a wide range of benefits to the US economy not least of which is new employment. In 2012 alone 65,000 new jobs were created in the industry according to TIPRO. The TIPRO report breaks down employment increases by sector including 36,000 new jobs in operations and support activities, 12,750 jobs in crude oil and gas extraction and close to 8,000 jobs in oil and gas field machinery and equipment. State by state the biggest oil and gas employer by far is Texas (380,000) followed by Louisiana (81,400), Oklahoma (74,600), California (46,400), and Pennsylvania (34,900). During 2012 North Dakota saw the largest year on year growth in employment of 54 percent or 6,400 to 18,400, reflecting the dramatic increase in crude oil production from the prolific Williston Basin.

Shale production has transformed US energy pricing and competitiveness. Natural gas growth between 2009 and 2011 led to a collapse in prices to 10 year lows under $2/MMbtu early in 2012. Domestic crude oil prices also fell by around $20/Bbl during 2011 against international levels as new US and Canadian production flooded the Midwest region with supplies. Low natural gas prices compared to crude encouraged a move away from dry natural gas drilling towards “liquids rich” plays that in turn led to higher NGL production volumes.

Lower crude prices and lower natural gas fuel costs improved the competitiveness of US refiners. As a result while US demand for refined products such as gasoline and diesel has declined, exports have increased dramatically. According to the EIA net US exports of diesel and gasoline were close to 1 MMb/d and 500 Mb/d respectively in 2012 – much of it to Latin America. Prior to 2008 the US was a net importer of both diesel and gasoline. Although US crude prices have been lower and production of light sweet crude grades is rapidly exceeding refining capacity in some regions, Bureau of Commerce regulations forbid the export of crude oil except to Canada. That country is self sufficient in crude but they do import from the US significant volumes of light distillates and very light crude oils called condensates as diluent for heavy bitumen crude (see Fifty Shades of Eh).

Join Backstage Pass to Read Full Article