Any number of things can impact the price of specific types of crude oil at various locations — supply interruptions, takeaway constraints and refinery outages, to name just a few. Every so often, the stars align and just about all those factors narrow the differential between, say, Western Canadian Select (WCS) and West Texas Intermediate (WTI) at the U.S. Gulf Coast to near-record levels. Well, that’s happening now, for the first time in five years. In today’s RBN blog, we discuss the shockingly small WCS/WTI differential and what’s driving it.

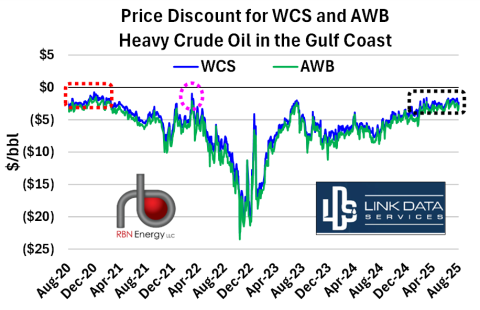

In recent months, the price differential for WCS — and Access Western Blend (AWB), another grade of Canadian heavy crude that is actively traded for physical delivery to Gulf Coast refiners and exporters — have held near their narrowest values since the depths of the pandemic in 2020 (dashed red rectangle in Figure 1 below). Based on data collected in RBN’s weekly Crude Oil TradeView report, these two grades of heavy oil, priced in the spot market for physical delivery as a differential to the NYMEX-CME Calendar Month Average (CMA) crude oil price, have been sustained at discounts tighter than US$(3)/bbl under CMA since the beginning of June (dashed black rectangle).

Figure 1. Price Discount for WCS and AWB Heavy Crude Oil in the Gulf Coast.

Source: Crude Oil TradeView

This is the longest run of tight price differentials since the second half of 2020, when Canadian production curtailments in the wake of COVID disruptions created turmoil for the physical oil market. Only for a brief time in March 2022 (dashed pink circle) were differentials comparable to the current and 2020 tight price differential cycles. For most of the past five years, the differential has been between $(5)/bbl and $(20)/bbl, with the widest differentials coming in late 2022 and early 2023 when a host of international factors pressured the price discounts wider (see I Go to Extremes). These included the nearly yearlong sale of competing medium-sour barrels from the U.S. Strategic Petroleum Reserve (SPR) and the heavy discounting of Russian medium-sour Urals crude that came about after its invasion of Ukraine and the international sanctions on that country as a result (see Synchronicity).

Join Backstage Pass to Read Full Article