For a few days last week, Canada experienced a nationwide shutdown of its rail transportation network — the backbone of its economy. Of the literally thousands of items railed across Canada to consumers and for export to the U.S. and overseas, we consider three important liquid energy commodities — crude oil, propane and butane — that are transported by rail to provide some perspective on the volumes and dollar values that could have been jeopardized by an extended shutdown. In today’s RBN blog, we summarize the short-lived disruption to Canadian and international commerce and tally the impacts that could have been.

It’s often taken for granted, but rail transportation is critical to the North American economy — not just Canada but the U.S. and Mexico too. Machinery, automobiles, grains, coal, lumber, consumer goods, chemicals, and many other things move by rail every day to keep items on shelves for consumers, move raw materials to processing centers and for export to overseas customers.

In the case of Canada, rail is not only a backbone, but also a lifeblood for its economy. Possessing a huge land area — the second largest of any country on Earth, and more than 14 times bigger than Texas, but with only a few major population centers and export/import ports separated by hundreds or thousands of miles — moving large quantities of raw materials and finished goods in most cases can only be done on an economic scale by railing. This is even more important in the case of commodities such as lumber, coal, grains, some crude oil, and liquid petroleum gases (LPGs), such as propane and butane. It is not an exaggeration to suggest that without railing, a sizable portion of Canada’s economy would slowly grind to a halt.

It also has to be noted that Canada is special in that it has a decades-old reputation as a reliable supplier of commodities to the U.S. and other trading partners.

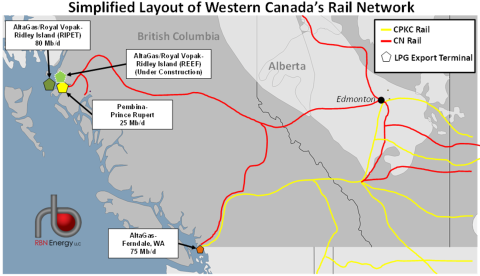

On August 21, that reputation for the reliable delivery of liquid energy commodities such as crude oil, propane and butane (this is RBN, after all!) was temporarily dented by a nationwide shutdown of rail transportation by Canada’s two primary rail companies: Canadian National (CN) and Canadian Pacific Kansas City (CPKC). (The latter was formed by the 2023 merger of Canadian Pacific and U.S. rail carrier Kansas City Southern.) CN and CPKC have their own rail corridors in Canada and an extensive network of track in the U.S., with CPKC extending its footprint into parts of Mexico.

We won’t delve into many specifics behind the shutdown, but due to various timing issues related to the extension of collective bargaining agreements (both of which expired at the end of 2023) between rail companies and locomotive engineers, conductors, rail traffic controllers, and train and yard workers — as represented by the Teamsters union — the final deadline to reach a formal collective bargaining agreement eventually fell on the same day and time: midnight Eastern Time (ET) on August 21. From that point, the employees were legally entitled to file a strike notice and the rail companies were in the position to lock out the employees. The end result was an unprecedented simultaneous shutdown of Canada’s two primary rail carriers beginning in the wee hours of August 22.

Fortunately, it was a short-lived shutdown. With so much riding on the rails — literally and figuratively — for Canada’s economy, the Canadian Federal Labour Minister, Steven MacKinnon, requested in the afternoon of August 22 that the Canadian Industrial Relations Board (CIRB) impose binding arbitration and direct the companies to end their lockout — and the workers to end their strike action — “forthwith,” as MacKinnon put it. The CIRB ordered on August 24 that both sides return to work with the expired collective agreements to be further extended until such time as a new binding agreement can be put in place by a third party (with both sides bound by its terms).

Since then, things have been muddied, with the rail companies and the unions both talking tough, but both agreeing that they would return to work effective August 26 (Monday), meaning the full shutdown lasted only four days. Neither side appears happy with the outcome, and we expect there could be more noise and some limited potential for further disruptions in the railing of goods to export markets and consumers. Meanwhile, it’s back to business, but it may take a few weeks to clear up the backlog, as some cross-border shipments with the U.S. had already been slowed or stopped in anticipation of the shutdown.

This is where we (finally!) turn to what is at stake for Canada’s liquids energy industry on the rails, one that moves some crude oil and a great deal of LPGs and could have been upended by an extensive shutdown. Our goal with this blog is to give some sense of the scale of what was at stake and the importance of railing in the export of crude oil and LPGs.

Figure 1. Simplified Layout of Western Canada’s Rail Network. Source: RBN

Join Backstage Pass to Read Full Article