After setting an annual record of 4.1 MMb/d in 2024, U.S. crude exports started off this year relatively strong, but cracks soon began to show, with volumes falling all the way to 3.2 MMb/d in July, one of the weakest months since 2023. But just when it seemed the momentum was gone, Gulf Coast exports rebounded to near 3.9 MMb/d in August and are topping 4.1 MMb/d so far in September. In today’s RBN blog, we look at how shifts in production, imports and refinery runs have impacted U.S. crude exports.

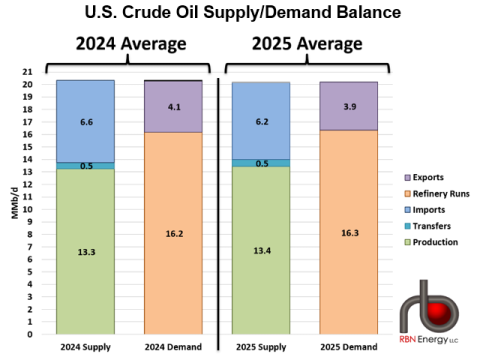

On paper, the math behind the U.S. supply/demand crude oil balance is straightforward: Production + Imports = Refinery Demand + Exports. Figure 1 below shows the U.S. balance in 2024 (left side) versus what we’ve seen so far, on average, in 2025 (right side).

Figure 1. U.S. Crude Oil Supply/Demand Balance. Source: RBN

Every piece of this equation has been shifting under our feet in 2025, with a notable change in the export market — a critical factor in balancing trade. So what’s really going on and what contributes to these changes? Let’s take a tour through the pieces of the above supply/demand balance to see what’s changed since 2024.

Production

For the better part of a decade, U.S. shale was the growth story in global oil. But 2025 is showing us what happens when that engine starts to sputter. In 2024, U.S. production edged about 2% higher, averaging 13.2 MMb/d, with the Permian Basin continuing to shoulder most of the growth and offshore production from the Gulf of Mexico (GOM; see Take a Chance on Me) displacing some medium sour crude imports. By early 2025, production pushed up to around 13.5 MMb/d. But since then, things have leveled off. Efficiency gains that once delivered double-digit growth rates are harder to come by. Resource quality is slipping in some plays, capital discipline remains a priority for operators (see Here Comes the Rain Again), and service costs have stayed sticky. Despite continued increases in U.S. production the last few years, the rate of growth has been slowing as we near our 2025 year-to-date (YTD) average of 13.5 MMb/d.

Join Backstage Pass to Read Full Article