Over the past month, E&P executives have addressed shareholder and analyst concerns amid the murkiest market conditions since the onset of the pandemic in Q1 2020. One industry leader pointed out that on an inflation-adjusted basis, there have only been two quarters since 2004 when front-month oil prices have been as low as they are today (excluding 2020). In today’s RBN blog, we review what we heard from E&P brass — a measured response that melded confidence in the industry’s new fiscally conservative, shareholder-focused business model; modest spending reductions; and preparations for more substantial responses to future erosion in commodity pricing.

Producer commitment to their current investment strategy was showcased in a quote from Coterra Energy CEO Thomas Jorden, who said his company “is an ark, not a party boat.” The emphasis is on financial stability through maximizing free cash flow and prioritizing shareholder returns. Travis Stice, Jorden’s counterpart at Diamondback Energy, pointed out that the U.S. shale industry has evolved to this mature stage of development from the initial proof of concept, when E&Ps frequently outspent cash flow. Capital spending by the 38 companies we follow declined 3% from full-year 2023 to 2024 as oil prices fell and remained at the reduced level in their original 2025 guidance as E&P managements ignored exhortations from the new Trump administration to dramatically increase production.

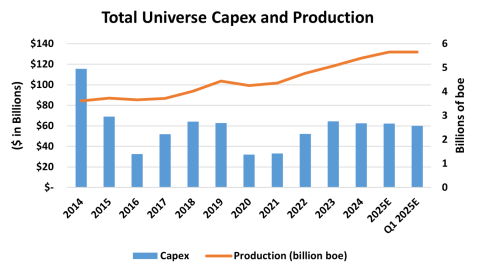

The average monthly price for WTI hit a 2025 peak in January at $74.68/bbl, then fell through the $70/bbl mark in March and averaged $60.76/bbl through the first three weeks of May. Concerns about future oil pricing have arisen based on slowing economies, OPEC production increases, and the potential impact of tariffs. As a result, producers cut 2025 capital spending estimates during their Q1 2025 earnings releases by 4%, or approximately $2 billion, to $60.1 billion (blue bar at far right and left axis in Figure 1 below). The Oil-Weighted E&Ps shaved off $1.1 billion, or 4%, from original capital outlay estimates to $23.3 billion. The Diversified E&Ps are guiding to a $1 billion, or 4%, reduction in capex to $25.9 billion. The Gas-Weighted E&Ps, which are seeing stronger pricing for most of their output, trimmed spending by a modest $125 million, a little under 1% of their capex budgets, to $10.9 billion.

Figure 1. E&P Capital Spending and Production, 2014-Q1 2025E.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article