Let’s face it — for producers, the last couple of years have stung, with low-slung energy prices allowing little-to-no returns on drilling investments in most parts of the major shale basins. A side effect of the low price environment in the past two years has been the shrinking geographic footprint of the Shale Revolution. About 50% of all onshore rigs in the Lower 48 currently are clustered in the top 20 counties for drilling activity. In effect, this also means a lot of the new production growth will come primarily from these same 20 counties, with the potential for all sorts of implications for infrastructure and regional price relationships. In today’s blog, we take a closer look at rig counts by county to see how much the geographic focus of the Shale Revolution has narrowed.

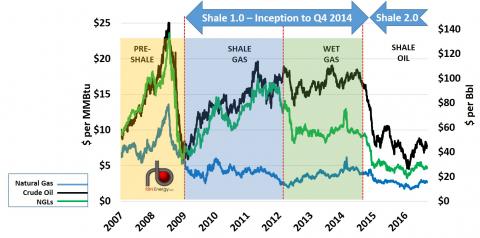

Before we jump into current drilling activity, let’s take a step back and briefly review the pricing dynamics that have led to the current situation using Figure 1, which puts the price of crude oil, NGLs and natural gas on a common denominator - $/MMbtu. .Less than a decade ago, back in 2007-09 — the Before Shale Era (yellow area in Figure 1) — the prices of natural gas (blue line), natural gas liquids (NGLs; green line) and crude oil (black line) generally moved in tandem. In the commodity run-up of early to mid-2008, prices for all three commodities blew out, and when the financial crisis hit later that year, all three crashed.

Figure 1; Source: RBN Energy (Click to Enlarge)

By 2009, technological advances in shale drilling had come to natural gas, marking the Shale Gas Era (blue area in Figure 1), and pricing for the products began to diverge. Rapidly growing natural gas production and increasingly oversupplied market conditions kept natural gas prices relatively low, while crude and NGL prices recovered along with the global economy. That gave producers the perfect incentive to shift their attention and resources toward “wet” gas shale areas that produced significant volumes of NGLs. But then the same thing happened to NGLs that had happened to gas a few years earlier: NGL supply growth muted prices. That was really good for petrochemical and other NGL consumers, but producers whose returns were growing thinner on the lower NGL prices were again getting antsy. But crude oil – with its pricing determined in a much more global market – held up, at least for a while. So producers moved even more of their drilling to crude oil areas. U.S. crude oil production had taken off by 2012, and it was just a matter of time before crude would experience the same thing as gas and NGLs. And as we all know by late 2014, it did, as shown in the white area to the right in Figure 1. Prices crashed for all three commodities, but hardest for oil. We call the period before the crash Shale 1.0, because when gas and NGL prices dropped, producers could move to another commodity market to keep returns high. But with all three commodities in the tank, producers were forced to deal with the reality of low margins, possibly for an extended period of time. This new reality is what we call Shale 2.0, the implications of which on drilling decisions and activity are still unfolding.

Join Backstage Pass to Read Full Article