There’s been a lot of speculation about whether the pace of electric vehicle (EV) adoption has slowed, with JD Power now expecting EVs to make up 9% of U.S. new-car sales in 2024, down from its earlier estimate of 12.4% but still up from 7% in 2023. The group remains bullish on EVs in the long term, expecting market share to reach 36% by 2030 and 58% by 2035. The forecast from RBN’s Refined Fuels Analytics (RFA) group forecast has been — and continues to be — more conservative than most but still anticipates EVs will reach 50% of U.S. new-car sales by the early 2040s. In today’s RBN blog, we’ll look at what drives these forecasts and the anticipated impacts on gasoline demand.

In observance of Veterans Day, we’ve given our writers a break and are revisiting a recently published blog on EVs and gasoline demand. If you didn’t read it then, this is your opportunity to see what you missed! And to our vets, thank you for your service.

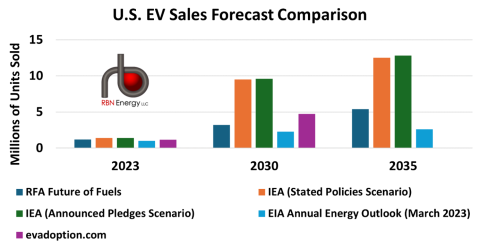

RFA’s forecasts for EV sales growth (dark-blue bars in Figure 1 below), which were part of its latest Future of Fuels report published in July, are dwarfed by those from other groups, notably JD Power and the International Energy Agency (IEA). The IEA’s most recent report, from April 2024, put U.S. EV sales at 1.4 million in 2023, 17% higher than RFA’s own estimate of 1.2 million. However, the IEA expects U.S. EV sales to reach 9.5 million by 2030 in its Stated Policies scenario (orange bars), 3X the RFA estimate. Its Announced Pledges scenario (green bars), which assumes all climate-related goals will be met, forecasts slightly higher EV sales. The Energy Information Administration (EIA) has not released a new EV sales forecast since its 2023 Annual Energy Outlook (AEO; light-blue bars) but was relatively bearish on EV sales in that report, expecting sales to grow to only 2.3 million by 2030. (The EIA chose not to publish an AEO in 2024 as it updates its models.) Evadoption.com (purple bars), which provides a free EV sales forecast, expects U.S. EV sales to reach 4.7 million by 2030. Figure 1 below illustrates the differences in these forecasts. (For reference, annual total domestic new vehicles sales averaged 16.6 million for the 10-year period between 2014-23.)

Figure 1. U.S. Sales Forecast Comparison. Source: Refined Fuels Analytics

Join Backstage Pass to Read Full Article