These days natural gas can be traded in spot, term, or financial at over 120 locations across the US. Deals can be executed by Apps, by instant messages and by high-speed algorithm. And it is reported that a few human beings actually still trade gas bilaterally over the telephone as was done in the time of the Cro-Magnons. None of that would be happening without the big bang. Today we recall how the dust settled after the big bang in natural gas markets.

In case you were directed to this post by a flaw in your search engine, we should start by emphasizing that our topic is not about the start of the universe nor a hit show on CBS. The big bang we are discussing happened to the natural gas market in 1992. That’s when a revolution was sparked by Federal Energy Regulatory Commission (FERC) Order 636. That revolution marked the beginning of gas trading as we know it today.

In fact, it may surprise you, but until the mid 1980s, natural gas did not trade at all. Back in the time of the dinosaurs there was no spot market. No futures market. Nothing but gas engineers (some with plastic pocket pen protectors) selling production to pipelines on life-of-lease contracts at prices set by the government. So for those of you who weren’t yet tall enough to take part in those heady days we thought it was time to do a series of blogs about how the gas market got to where it is today, and where it is going from here.

FERC Order 636

On April 8, 1992 FERC Order 636 was issued, changing the natural gas industry forever. Known as the “Restructuring Rule,” Order 636 forced transparency onto an industry dominated by pipeline owners, who up until then owned and controlled all of the gas in their pipeline systems, including the gas held in storage facilities.

FERC Order 636 “unbundled” or split out interstate pipeline company merchant functions from transportation and storage service functions. Previously interstate pipeline companies bought gas from producers at one end of the pipe and sold it at the other under long term contracts. Pipeline and storage capacity to transport gas from producers to buyers was used to support this gas service. Most buyers were either big industrial companies or large, state-regulated utilities called local distribution companies (LDCs) who ultimately supplied natural gas to end users within their respective territories.

After Order 636, pipeline operators (or the operating units of companies responsible for pipeline operations) couldn’t “buy and sell” gas anymore - only transport it for others. Old (and very long and wordy) sales contracts were converted to transportation contracts. FERC’s intent was to create a fully functional commodity market for natural gas in which any market participant could buy, sell, transport, store or otherwise manage natural gas assets. Around the same time, price controls on the price of natural gas were also eliminated. This was the beginning of a deregulated commodity moving in regulated pipelines and storage infrastructure.

In this new world, all gas was to be transported for all buyers or sellers in the same way, governed by two legal agreements:

1. A firm transport and storage contract between pipeline/storage operator and shipper with the following basic terms:

- Grants capacity to a shipper at one or more points along a pipeline. Capacity is either specific as to both location (point) and quantity or is general as to location and specific as to quantity.

- Gives a shipper the right to cause a transportation service provider to receive a specific quantity of gas from that shipper at a point and/or deliver a specific quantity of gas to that shipper at point over a specific time period.

- A shipper can sell all or any portion of a contract for all or any portion of the effective time period (capacity release).

- Shippers have flexible receipt and delivery point rights which provides additional inlet and outlet points to use on an as-available basis even though the points were not specified in the shipper’s transportation services contract.

2. A cost-based transportation tariff rate determined as follows:

- Interstate pipeline transportation tariff rates are set by the pipelines subject to FERC rate cases.

- The rate making mechanism is usually cost-of-service using a straight-fixed-variable rate making structure.

- Most interstate pipeline rates are zonal-based (a specific cost to move gas from one rate zone to another); some are point-to-point, others are “postage stamp” (the same cost from any receipt point to any delivery point on the system).

- The two primary classifications of rates are firm and interruptible. Firm rates are generally much more expensive than interruptible rates.

- Pipeline rates are typically composed of two major components: a fixed demand charge or reservation charge paid by the shipper to the pipeline to reserve the right to move gas and a variable component, made up of several sub-components.

- The most significant variable sub-components are the commodity rate (an amount paid per MMbtu of gas actually transported) and the fuel rate (a percentage of the value of gas paid per MMbtu of gas actually transported).

Trading and Pricing

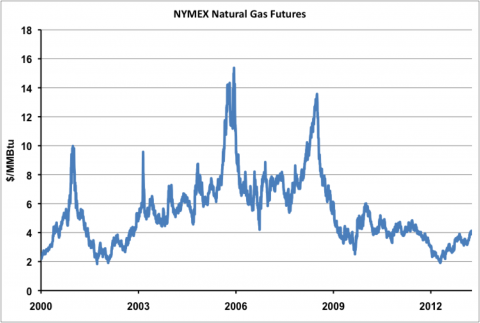

By unbundling transportation and storage services from buying and selling of the commodity, and by permitting capacity releases, Order 636 ushered in an era of expanded wholesale natural gas trading. In the years since 1992 natural gas trading has boomed (remember Enron Online?) and bust (remember Enron Offline?). Five years ago (2008) natural gas trading was in the midst of another boom as prices rose to $13/MMBtu. In the past two years the basis between natural gas trading points shrunk to a fraction of previous levels (see Honey I Shrunk the Basis) and left gas trading rooms counting the cobwebs again.

The makeup of molecules flowing through pipes in the Rocky Mountains is basically the same as those flowing through pipes in the Northeast. Economists call that fungibility. That makes it possible to easily buy and sell natural gas at various trading hubs across the country. Hubs are typically delivery points or meter stations at the intersections of major pipelines. The price for gas at these hubs can vary greatly on any given day due to fluctuations in supply, demand and pipeline capacity. Natural gas prices can be quite volatile, particularly during extreme weather events. The chart below shows the fluctuation in natural gas NYMEX futures prices at Henry Hub, LA since 2000.

Source: CME data from Morningstar (Click to Enlarge)

There are four key markets for natural gas: the physical spot market, the term or contract spot market, the futures market (regulated financial trading), and the over-the-counter financial market (unregulated financial trading). Traders can buy or sell in any of these markets and often rely on complex data analysis to help determine what they do and where they do it. Here’s a little more about each market (we will be covering trading around the key natural gas hubs in more detail in future RBN Energy posts).

Physical Spot

The spot market is the daily market where natural gas is bought and sold for immediate delivery. Immediate usually means that the gas flows the next day but on Fridays or before holidays, gas is traded for multiple flow days ahead of time. (There is essentially no physical natural gas traded on weekends or holidays. That would be uncivilized.) Once a trade occurs, the transaction is “nominated” to pipelines by schedulers using web-based software that confirms the nomination. Actual flows (movement and title transfer) on pipelines or in storage facilities happen the next day for a 24-hour daily flow. Nowadays the majority of trading occurs online via electronic trading platforms such as WebICE that is owned by Intercontinental Exchange (ICE). Trading platforms such as ICE and price reporting agencies such as Platts and Natural Gas Intelligence publish end-of-day assessments based on reported transactions at liquid trading hubs including weighted averages of transactions called Index Prices.

Join Backstage Pass to Read Full Article