Fast-rising NGL supplies during the early years of the Shale Era fueled excitement about the potential for new petrochemical plants in the U.S., especially ethane-only crackers to make ethylene and other byproducts, along with propane dehydrogenation (PDH) plants to make propylene. While 11 new ethane-fed crackers have come online in the U.S. since the mid-2010s and the world’s largest — Chevron Phillips Chemical and QatarEnergy’s 4.8-billion-lb/year facility — is under construction in Texas, only three of the many PDH projects proposed over the same period were actually built. In today’s RBN blog, we’ll look at why the initial rush of new PDH project announcements resulted in so few new U.S. plants.

The Shale Revolution changed a lot of energy fortunes in the U.S. Pre-shale, the U.S. had become heavily dependent on foreign crude oil and was planning to import LNG to help meet natural gas demand, but with shale, the U.S. is now the world’s largest producer of oil, gas and NGLs and a significant exporter of all three. Plentiful domestic supplies of NGLs and purity products like ethane, propane, butanes and natural gasoline also helped revive the petrochemical industry and turn the U.S. into a global supplier of both petchem feedstocks and plastic resins.

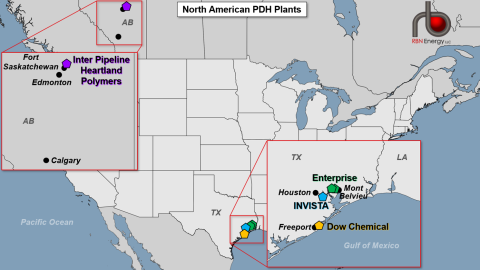

Figure 1. North American PDH Units. Source: RBN

Before 2015, the U.S. had a slew of mixed-feed crackers that were built to “crack” different feedstocks such as ethane, propane, butane, naphtha and gas oil to produce ethylene, propylene and other byproducts — the building blocks of too many chemicals to count. INVISTA’s Houston-area facility (blue pentagon in Figure 1 above) — built by PetroLogistics LP in 2010 and later sold to Koch Industries — was the only PDH unit in North America at the time as propylene demand was largely met with enough “byproduct” production — propylene output from mixed-feed crackers or refineries. There are now five PDH units operating in North America (more on those later).

Join Backstage Pass to Read Full Article