Last Thursday (March 28, 2013) the CME Henry Hub natural gas futures contract closed out the first quarter of 2013 at $4.024/MMBtu (prices slipped 0.9 cents to $4.015/MMBtu Monday). A year ago the futures price was $2.126/MMBtu – about half what it is today. During that same period, US dry gas production has risen by 0.5 Bcf/d to 64.1 Bcf/d and natural gas power burn has fallen by 2.2 Bcf/d (source: Bentek). With production still increasing and demand from power generation falling it seems unlikely that the market can sustain $4/MMBtu prices. Today we look at the supply demand picture at the end of the winter season.

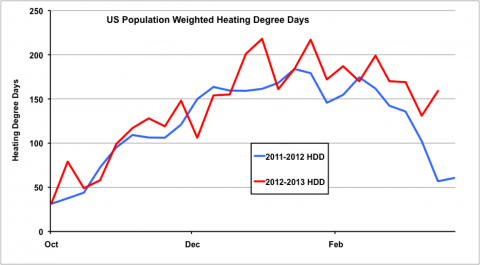

The 25 percent run up in natural gas futures prices that we have seen during the first quarter of 2013 was caused primarily by colder weather increasing demand. The chart below shows US population weighted heating degree days (HDD - see Under the Weather – Cooling Degree Days for a description of how degree days are calculated). There were more HDDs during 2012-13 (red line) indicating that this winter was colder than the winter of 2011-12 (blue line) and you can see that since January temperatures this year have been quite a bit colder than last.

Source: National Oceanic Atmospheric Administration Data from Morningstar (Click to Enlarge)

Winter months generally see withdrawals of natural gas from storage as demand exceeds available pipeline supply from producing regions. Energy Administration Information (EIA) data shows that by the end of last winter (2011-12) natural gas storage had reached record levels for March – about a 40 percent surplus over the average of the previous 5 years. Colder weather this winter increased heating demand enough to whittle away nearly all that surplus over the 5 year average by the end of March. The chart below shows EIA natural gas estimated Lower 48 storage data for this winter (red line), last winter (blue line) and the 5 year average (green line). A larger than expected storage withdrawal last week (March 22, 2013) brought inventory down to within 60 Bcf of the 5 year average (black circle on the chart).

Source: EIA Data from Morningstar (Click to Enlarge)

To delve a little deeper into the factors that have impacted the gas market this winter and have a bearing on what we can expect this summer, we looked at the Bentek Cell Model daily natural gas supply demand balance for March 21, 2013. The table below shows the data with the supply position summarized in the top half and demand at the bottom. The left hand side of the table compares March 2013 against March 2012 and on the right are YTD comparisons. The supply data shows that natural gas dry production increased by 0.8 percent in 1Q 2013 to 64.1 Bcf/d versus the same period last year 63.6 Bcf/d (red circle) and by 1 percent this March versus last (blue circle). These increases in production come in spite of continued reduction in the Baker Hughes gas drilling rig count to a 14 year low (March 28, 2013). Improved drilling efficiency is part of the reason for this apparent contradiction but also new pipeline and processing plant infrastructure coming online is increasing the amount of gas that can be produced from a large inventory of incomplete wells.

Join Backstage Pass to Read Full Article