Serious concerns about higher costs and lower demand have left the E&P sector in a delicate position since the implementation of new U.S. tariffs, as evidenced by the Dallas Federal Reserve Bank’s recent survey of producers, who appear especially vulnerable after massive acquisition spending in 2024 to deepen and high-grade their portfolios. In today’s RBN blog, we’ll explore the impact of the 2024 acquisitions and commodity pricing on E&P debt and discuss the expected response to protect balance sheets.

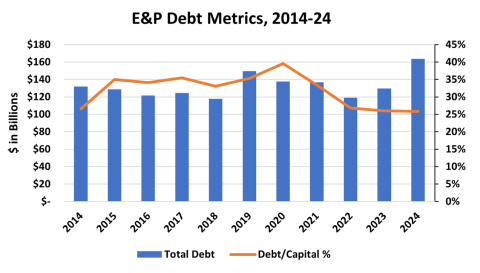

As shown in Figure 1 below, the debt-to-capital ratio (orange line and right axis) for the 39 major E&P companies we cover peaked at a concerning 40% in 2020 as commodity prices cratered. A strong price recovery and strict fiscal discipline led to a steep decline in leverage in 2021-22 as E&Ps fixated on keeping capital outlays far below cash flows and using the free cash to pay down debt, provide dividends and buy back shares. Despite declining oil prices, cost control was a major factor in sustaining that level in 2023.

Figure 1. E&P Debt Metrics, 2014-24. Source: Oil & Gas Financial Analytics LLC

The acquisition spree within the E&P sector drove total debt (blue bars and left axis) sharply higher in 2024: Total debt rose to $164 billion from $130 billion in 2023. The debt-to-capital ratio was unchanged because most of the transactions were funded with the issuance of equity, which also sharply boosted the total capital of the 39 companies we monitor.

Figure 2 below plots debt per barrel of oil equivalent (boe) of reserves (blue line) versus the PV10 value of oil and gas reserves (orange line), which is the primary collateral for most E&P lending. (The PV10 value represents the present value of estimated future oil and gas revenues — based on the first-of-the-month, 12-month average price — less estimated direct expenses and discounted at an annual rate of 10%.) WTI oil prices in the PV10 calculation fell 3.6% in 2024 to $75.48/bbl, while Henry Hub natural gas prices fell 16.7% to $2.35/MMBtu. As a result, the PV10/boe declined from $7.00/boe in 2023 to $6.54/boe in 2024 (right end of orange line).

Join Backstage Pass to Read Full Article