U.S. E&Ps’ strategic shift from growth at any cost to a laser focus on cash flows to fund shareholder returns revitalized their investor base. But that strategy has been challenged as crude oil prices have eroded since their mid-2022 peak, with producers struggling to balance the need to maintain output and the pressure to sustain dividends. In today’s RBN blog, we’ll see how things are going with the oil and gas companies that bear no responsibility for the costs and complications associated with the finding, development and production of hydrocarbons — the entities that own mineral and royalty interests.

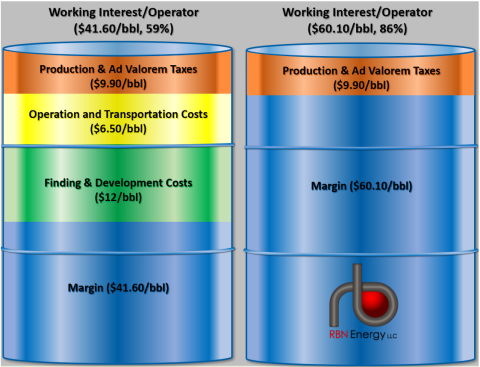

We first discussed this industry segment two years ago in Money for Nothing, which provided an extensive overview of mineral and royalty interests, which receive about 20% of the gross revenues generated by oil and gas wells. Figure 1 below illustrates the higher percentage of revenues received by holders of mineral and royalty interests on a barrel of crude priced at $70/bbl. In this example, the working interest holders (left barrel) are responsible for the $12/bbl of finding and development costs (F&D; green section of barrel), the $6.50/bbl of operating and transportation costs (yellow section), and the $9.90/bbl in taxes (orange section), resulting in a net of $41.60/bbl, or 59% of the gross revenue. The mineral/royalty interests on the right, in turn, are responsible only for the $9.90/bbl in taxes, resulting in net revenue of $60.10/bbl, or 86% of gross revenue.

Figure 1. How Crude Oil Proceeds Differ Between Working Interests and Royalty Owners.

Source: Oil & Gas Financial Analytics, LLC

Because they incur little or no production and exploration expenses, it’s no surprise that significantly higher proportions of realized revenues of royalty/mineral trusts (RTs) flow through to the bottom line. As shown in Figure 2 below, Q1 2025 pre-tax operating cash flows (green bar segments in group to far right) and operating income (dark-blue bar segments) for the seven RTs we monitor (Kimbell, Viper, Dorchester, Blackstone, Sitio, Freehold and PrairieSky) were $38.33/boe and $24.62/boe, respectively. That’s 41% and 65%, respectively, higher than the average for our universe of 40 E&P companies (light blue and orange bars). The RTs retained 92% of realized pricing as cash flow and reported 59% of realized pricing as income, compared with 70% and 38%, respectively, for the E&Ps. Only the depreciation, depletion and amortization (DD&A) expenses of RTs ($13.21/boe) exceeded that of E&Ps ($10.92/boe), likely because of the higher acquisition costs by royalty companies.

Join Backstage Pass to Read Full Article