Natural gas storage — especially well-sited storage with lightning-fast deliverability rates — is taking on a new significance (and value) as LNG export facilities and power generators seek to manage their often-volatile gas demand. But developing new gas storage capacity is costly and, with only a few exceptions, it’s hard to make an economic case for greenfield projects. That reality has spurred a lot of interest among midstream companies in acquiring existing storage assets and, where feasible, expanding that storage. In today’s RBN blog, we discuss one of the biggest storage-acquisition deals to date: Williams Companies’ recent purchase of six facilities with a combined working gas capacity of 115 Bcf in Louisiana and Mississippi. (It’s not all that Williams has been up to on the gas-storage front.)

As we said in our Squeeze Box series last year, storage has long been a critically important balancing mechanism in the Lower 48 natural gas market. In the Pre-Shale Era and the early days of the Shale Revolution, the storage market was driven primarily by the intrinsic value of capacity — i.e., the need to sock away gas in the lower-demand summer months for use in the peak winter months. More recently, the value of storage is being driven almost exclusively by extrinsic economics — i.e., how flexible and responsive capacity allows market participants to manage supply and demand during short-term market swings. This flexibility and responsiveness have become more important criteria for ensuring reliability as LNG export terminals and an increasingly renewables-heavy power sector navigate frequent gas-demand fluctuations day to day — or even intraday — as well as high-stakes, extreme weather events like 2021’s Winter Storm Uri and the cold snap that gripped Texas in mid-January.

Take LNG export facilities. A number of factors can cause frequent and often-sizable swings in LNG feedgas deliveries: things like planned and unplanned pipeline or liquefaction-plant maintenance, intraday temperature fluctuations that can affect facility operations — even foggy weather that slows or stops marine traffic. As a result, operators often need to be able to call on incremental gas or inject volumes on short notice. Gas suppliers and pipelines can help manage the ups and downs, but they can’t always accommodate big swings in volumes equivalent to a large-scale liquefaction train. That’s where storage comes in.

In a similar vein, the increasing amount of variable-output renewable generating capacity that helps power the electric grid keeps the operators of gas-fired power plants on the edge of their seats — their facilities always need to be at the ready to either ramp up or ramp down their electric output to compensate for the ever-changing (and often unpredictable) output of wind farms and solar facilities. That means that generators often need reliable access to significant volumes of gas on very short notice. Again, nearby gas storage can provide a much-needed, much-welcomed assist.

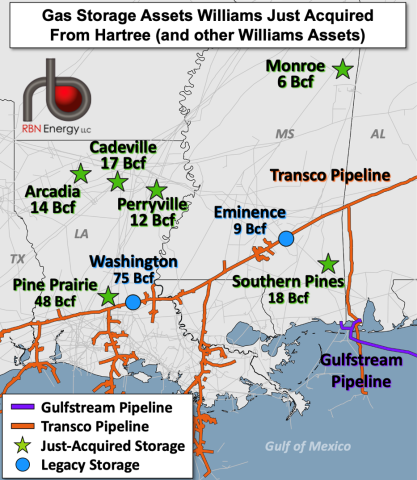

With the heightened demand for flexible, responsive gas storage top of mind, Williams earlier this month closed on the $1.95 billion acquisition of a portfolio of six underground gas storage assets in Louisiana and Mississippi from an affiliate of Hartree Partners LP. The half-dozen storage facilities (green stars in Figure 1 below) have a total capacity of 115 Bcf and — just as important, and maybe more so — a combined injection rate of 5 Bcf/d and a combined withdrawal rate of 7.9 Bcf/d. Those “deliverability” numbers are extraordinarily high and therefore are of particular value to storage customers like LNG facilities and gas-fired power plants that need to either receive or send into storage large volumes of gas at the drop of a hat.

Figure 1. Gas Storage Assets Williams Just Acquired From Hartree (and Other Williams Assets).

Source: RBN

Join Backstage Pass to Read Full Article