The U.S. has become an oil-exporting powerhouse in recent years, propelled by booming shale production, notably from the Permian Basin. U.S. crude oil now flows more freely than ever to help meet global demand, including to Europe, which increasingly turned to the U.S. following Russia’s invasion of Ukraine two-plus years ago, but exports have slowed recently. In today’s RBN blog, we examine a half-dozen reasons why the export surge has tapered off and why it may not change much in the weeks ahead.

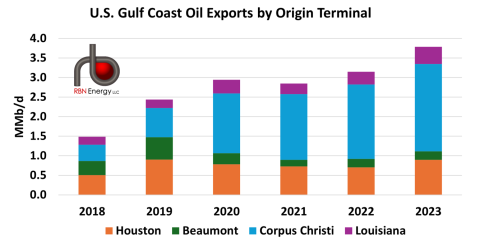

According to our weekly Crude Voyager report, where we track individual vessels leaving the U.S. Gulf Coast with crude oil, exports established an annual record in 2023, averaging 3.8 MMb/d (far-right bar in Figure 1 below), 20% more than the previous annual record set in 2022. Except for COVID-impacted 2021, U.S. crude oil exports have increased every year since 2015, when the ban on most crude oil exports was lifted.

Figure 1. U.S. Gulf Coast Oil Exports by Year by Origin Terminal. Source: RBN

Growth in crude oil production in the U.S. has propelled exports higher. Domestic production averaged 12.6 MMb/d in 2023, of which the Permian made up nearly half. And as noted in our weekly Crude Oil Gusher report, domestic production reached as high as 13.3 MMb/d earlier this year. Most of what is produced in the U.S., particularly in the prolific Permian, is light, sweet crude. But many U.S. refineries are optimized to run heavy, sour crude, leaving much of the West Texas Intermediate (WTI) produced in the Permian better suited for exports. (As a reminder, as of mid-2023, Midland WTI was made deliverable into the Brent complex, strengthening the role of U.S.-produced crude in export markets. We Are The World goes into the details.)

Join Backstage Pass to Read Full Article