Expectations for electric vehicle (EV) adoption in the U.S. took a sharp detour into uncharted territory earlier this month when President Trump signed the landmark budget reconciliation bill into law. Known as the One Big Beautiful Bill Act (OBBBA), the law dramatically scales back EV subsidies, eliminates penalties for automakers that don’t meet fuel-efficiency standards, and significantly restricts state-level zero-emission vehicle (ZEV) programs. In today’s RBN blog, we look at why the law is likely to slow the pace of EV adoption and impact forecasts for vehicle sales and gasoline demand — a key topic in the just-published Future of Fuels report from our Refined Fuels Analytics (RFA) practice.

We’ll start with one of the most significant changes in the OBBBA, or at least one that is very noticeable to consumers: the early termination of the New EV Tax Credit (30D), which has helped EVs move closer to price parity with internal combustion engine (ICE) vehicles. Under changes made to the tax credit in 2022’s Inflation Reduction Act (IRA), EVs complying with either critical mineral or battery component requirements are eligible for tax credits of $3,750 each, or $7,500 if a vehicle meets both. In addition, a tax credit of up to $4,000 was for the first time extended to used EVs. The IRA also gave buyers the option of using the credit as part of their down payment or as cash-back from the dealer. (Under earlier legislation, buyers had to wait until they filed their taxes in the following calendar year to receive the value of the credit.)

Those tax credits are ending as of September 30 — seven years earlier than under the IRA — but the OBBBA makes a couple other key changes as well. Leased EVs will no longer be classified as commercial vehicles, a loophole that has allowed leasing companies to claim the full tax credit, then pass it on to the consumer. (About half of new EVs are now leased, according to market reports, up from 15% in 2022. The industrywide lease rate for all new vehicles is about 25%.) In addition, the Commercial Clean Vehicle Tax Credit (45W) is also being discontinued. Businesses and tax-exempt organizations that purchase qualified clean vehicles — battery-electric, fuel cell and plug-in hybrid vehicles — for commercial use qualify for the credit. The credit can be up to $40,000 for larger vehicles (14,000 pounds or more, such as heavy-duty trucks, school buses and semis) and up to $7,500 for smaller vehicles.

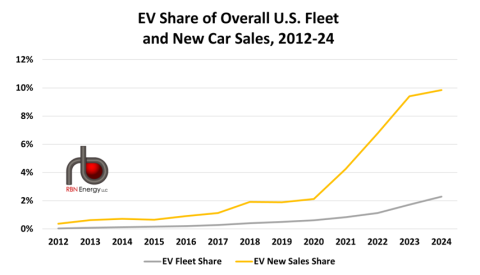

Figure 1. EV Share of Overall U.S. Fleet and New Car Sales, 2012-24. Source: RBN Refined Fuels Analytics

Join Backstage Pass to Read Full Article