One of the most important but elusive factors that drive movements in share prices is investor sentiment, a prevailing attitude toward anticipated future performance that past or current performance metrics may not justify. While the most extreme recent examples are social media-driven meme stocks like GameStop and AMC, no sector, including energy, is immune. Although we focus our E&P company analysis strictly on performance and price metrics, investor sentiment has and is playing a role in the share price movements among producer peer groups. In today’s RBN blog, we analyze the Q3 2024 results of the Diversified E&P peer group with an eye toward investor sentiment.

We have frequently referenced the brutally bearish investor sentiment that triggered a 95% plunge in E&P equity prices between 2014 and early 2020. This response was sparked by — but not fully proportional to — lackluster company performance in the face of commodity price volatility. The industry responded by transforming its investment strategy from prioritizing growth to maximizing shareholder return, which restored significant investor confidence during the strong post-pandemic commodity price recovery. E&P stock prices performed strongly in 2022-23 as some dividend yields reached double digits, far exceeding the average returns of other major sectors.

However, crude oil prices drifted lower in 2024, which in turn has eroded profits and cash flows. As we explained in our blog on Q3 2024 results, Who’ll Stop the Rain, pretax operating profits and cash flow for the 39 companies we cover fell 17% and 5%, respectively, extending a decline that began in Q4 2023. Since E&P share price movement has historically been closely tied to oil prices, it’s no surprise that the S&P E&P index was lower in Q3 2024; however, the decline was just 4% as investor sentiment varied significantly among the three E&P peer groups.

In a dramatic turnaround, Gas-Weighted producers dramatically outperformed, which we detailed in Something Good Coming. Recovering from a brutal Q2 2024, the group trimmed its operating loss by 81% to just $0.12/boe. More importantly, investors responded to widespread optimism about long-term future demand growth from LNG exports, data center power demand, and short-term weather-related price gains. As a result, the group’s average shareholder return rose 14% in the quarter as the share prices of seven of the nine companies moved higher during the period.

The average share price of the 15 companies in the Oil-Weighted peer group declined 8% during Q3 2024, matching the 8% fall in average realized prices; however, that result was driven by a particularly weak performance by the smallest producers in the group. The seven largest oil producers by revenue, whose assets are heavily weighted toward the Permian Basin, had an average share price decline of less than 2% as investors retained their holdings on strong financial discipline and the belief that these companies would benefit most strongly from regulatory changes by the new Trump administration. Their solid balance sheets allowed the group to continue their strong dividend programs that offset much of the share price decline. The result was just a 2% fall in total shareholder return.

Diversified Shareholder Returns

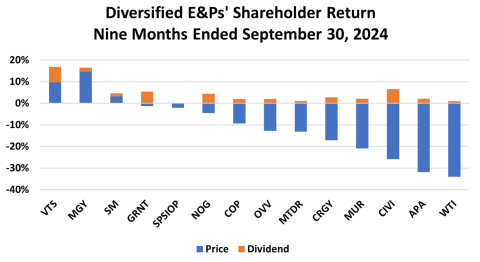

In strong contrast, the Diversified E&Ps posted by far the worst shareholder performance of the three peer groups we cover through the first nine months of 2024 with a -11% median return, as seen in Figure 1 below. The group’s average realized price fell 6% in Q3 2024, triggering an 8% decline in cash flow that matched the reduction of the oil producers. The average share price (blue bar segments) declined 11%, but the pattern of individual company performance was dramatically different from the Oil-Weighted group. The average share price of the seven largest companies by revenue fell an average of 19%, compared with just a 2% decline for the seven largest oil producers.

Figure 1. Diversified E&Ps’ Shareholder Return, Nine Months Ended September 30, 2024.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article