Observers of the natural gas market over the past 20 years know that the main story has been one of enormous growth. The Shale Revolution gave new life to the U.S. natural gas sector, leading to the record production levels we are seeing in early 2024. The economy has found many uses for this new gas: increased power generation, more pipeline exports to Mexico, expanded industrial gas usage and — most prominently — the many LNG export facilities that have cropped up since 2016. But with the pause on new LNG export licenses and the push to renewables in the power sector, there’s a looming question of where the new natural gas would go if production continues to expand. In today’s RBN blog, we look at how that new gas might be absorbed, both domestically and internationally, and what continued growth would imply for gas prices and producers in the long term.

Like economist Adam Smith’s butcher, baker and brewer, upstream producers are motivated by profit rather than benevolence. Therefore, future gas volumes vary drastically with different price assumptions. For the purposes of this blog, we are using a crude oil price that averages $70/bbl, which is in the ballpark of the current price curve. RBN projects that from 2024 to 2035, two-thirds of the growth in U.S. Lower-48 natural gas production will come in the form of associated gas from crude and liquids dominant basins like the Permian and Eagle Ford, so natural gas production growth will be more sensitive to the price of crude than for natural gas. (More on this in a moment.)

The gas price curve used for the projections in this blog averages $4/MMBtu over the next decade. This is a fairly bullish assumption given the current state of the futures market, where the front-month contract trades at less than half that level. On the other hand, there is a fair amount of contango currently, and the winter strip for much of the later 2020s often breaches the $4/MMBtu mark. We are also assuming that there will be no major change in policy radically overhauling where pipelines can be built and thus relieving constraints in key areas like Appalachia.

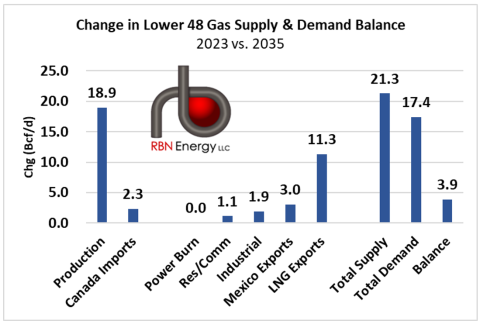

With that bit of throat-clearing out of the way, we anticipate significant natural gas production growth over the next decade, with the Lower 48 producing roughly 19% more in 2035 than in 2023 as production leaps by 18.9 Bcf/d (tall blue bar to far left in Figure 1) to an average of 121 Bcf/d, from less than 103 Bcf/d last year. Although the increase pales in comparison to the 66% jump in gas production from 2011 to 2023, we are still looking at a healthy amount of incremental gas. The growth trajectory is strongest over the next six or seven years, slowing to less than 1% year-on-year after 2030. We estimate that over half of the growth in U.S. production will come from the Permian Basin. Permian output is expected to rise by 40% to more than 26 Bcf/d by 2035. As noted above, producers there are more affected by the price of crude oil than the price of natural gas, and our base case crude price is high enough to incentivize significantly more oil coming to market. This volume growth will require new gas pipelines to be built between the Permian and demand centers on the Gulf Coast, in addition to the Matterhorn Express Pipeline that will add 2.5 Bcf/d of takeaway capacity starting later this year. However, given that these would be intrastate pipelines in Texas, the state’s relatively permissive regulatory environment shouldn’t be a significant barrier to construction.

Figure 1. Change in Lower 48 Natural Gas Balance, 2023 vs. 2035. Sources: RBN, EIA, Bloomberg

Join Backstage Pass to Read Full Article