At first glance, you might think that Phillips 66’s newly announced, $2.2 billion plan to acquire the EPIC NGL pipeline system, two fractionators near Corpus Christi and other NGL-related assets in Texas is just another logical step in the expansion of P66’s “well-to-market” NGL strategy — and you’d be right. But the story is actually much more interesting, involving a long list of well-known midstream players and a long-running, still-evolving effort to dilute the Mont Belvieu NGL hub’s dominance. In today’s RBN blog, we spill the tea.

We admit it. We have a soft spot for NGLs, which you could argue are the quirkiest, hardest-to-fathom hydrocarbons on God’s green earth. We also get a real kick out of developing a deep, inside-baseball understanding of the multi-layered complexities of energy markets — not just what’s produced where, how it’s processed and transported to market and what it sells for, but the stories behind the headlines and the reasons why things happen as they do.

The headline is this: P66 announced January 6 that it had entered into a definitive agreement to buy EPIC Y-Grade GP LLC and EPIC Y-Grade LP, two entities that own a set of significant NGL-related assets between the Permian and Texas’s Gulf Coast, for a total of $2.2 billion. The deal, which is subject to various regulatory approvals and expected to close later this year, is the latest in a series of P66 acquisitions that enhance the midstreamer/refiner’s ability to offer the full gamut of NGL-related services — everything from gas gathering and processing to NGL pipelines, storage, fractionators and export facilities.

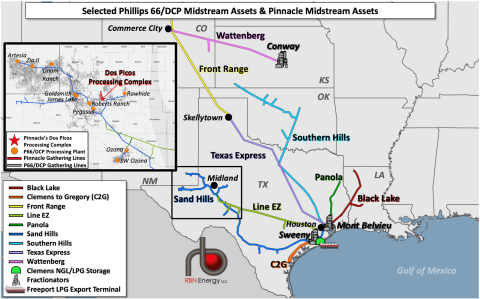

Most recently, we blogged about P66’s $550 million acquisition of Pinnacle Midstream (from Energy Spectrum Capital, a Dallas-based private equity firm) and its gas gathering and processing assets in the Midland Basin and, before that, about an increase in P66’s ownership interest in DCP Midstream (to an 86.8% stake) via deals it reached in 2022-23.

Figure 1. Selected Phillips 66/DCP Midstream Assets and Pinnacle Midstream Assets. Source: RBN

Join Backstage Pass to Read Full Article