Texas is the fastest-growing state for electricity consumption in the nation and the Electric Reliability Council of Texas (ERCOT), which is responsible for about 90% of the state’s electricity service, said earlier this year that peak power demand could nearly double in just six years — from about 85 gigawatts (GW) currently to as much as 150 GW by 2030. The sudden increase is driven primarily by data centers and artificial intelligence (AI), cryptocurrency mining, the state's growing population and increasing temperatures. In today’s RBN blog, we’ll discuss how Texas intends to address its growing appetite for power.

Power generation in the Lone Star State has been a frequent topic in the RBN blogosphere, and for good reason. Renewable sources of generation have been increasing in recent years, but Texas depends on natural gas-fired power for nearly half of its electricity needs, and the state’s entire energy industry — not to mention its petrochemicals sector — would grind to a halt without reliable sources of power. In Electric Avenue, we explained why Texas is unique; its deliberate isolation from other U.S. power markets frees ERCOT from most federal regulations. Also, ERCOT operates as an energy-only wholesale market, meaning that generators are only paid for the second-by-second energy they provide to the grid. (In a capacity market — the dominant approach in other organized power markets — generators are also paid a fixed fee for guaranteeing their power will be available when needed. That approach encourages the development of more dispatchable, around-the-clock power sources than an energy-only market like ERCOT.)

ERCOT’s energy-only market and the Texas grid’s stand-alone status are two defining elements of the state’s electric grid — a third is the state’s higher-than-typical reliance on variable renewable sources, especially wind but also solar. Yet another is the weather, including egg-frying temperatures that typically arrive in Texas in the spring and stick around into the fall — a topic we addressed in Hot Fun in the Summertime. For instance, sweltering temperatures caused Texas to set five new peak demand records in May. But there are also freakish wintertime events like the multi-day deep freeze (aka Winter Storm Uri) that nearly brought the state (and the grid) to its knees in February 2021 (see Terminal Frost). Most recently, ERCOT reported five winter peak demand records in January 2024 due to Winter Storm Heather. ERCOT CEO Pablo Vegas said during a board meeting on December 3 that there is a “slightly higher” grid reliability risk than last winter due to increased power demand, despite ERCOT’s efforts to strengthen the power grid since Uri. (ERCOT says it has conducted 3,000 weatherization inspections since 2021.)

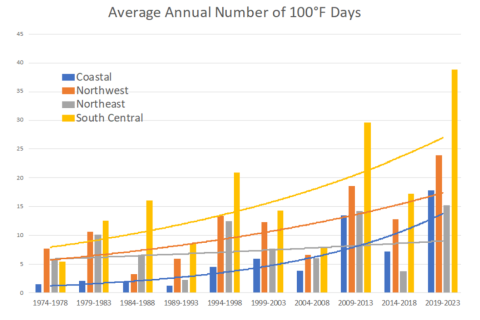

Now that we’ve addressed the unique nature of the ERCOT power grid, let’s discuss the factors triggering the state’s need for additional power, starting with its growing population. About 30 million people live in Texas today, but the Public Utility Commission of Texas (PUCT) predicts the state’s population could reach 50 million by 2050 — a 67% increase. As we mentioned, rising temperatures are also causing power demand to increase. An April report from the Office of the Texas State Climatologist at Texas A&M University, Assessment of Historic and Future Trends of Extreme Weather in Texas, 1900-2036, analyzed the four regions of Texas (see Figure 1 below), showing the increase of 100-degree days since the 1970s. The report analyzes the past 50 years and looks ahead to 2036. The analysis projects that there will be an overall quadrupling of 100-degree days by 2036, compared with levels in the 1970s/1980s.

Figure 1: Average Number of 100-Degree Days in Texas by Region.

Source: Office of the Texas State Climatologist, Texas A&M University

Join Backstage Pass to Read Full Article