Last week (April 9, 2013) South African firm SASOL held an investor strategy day in New York. The company confirmed it is moving ahead with plans to build a 100 Mb/d gas-to-liquids (GTL) plant in Lake Charles, LA. Shell is evaluating plans for a similar plant in LA. The plant feedstock will be up to 1 Bcf/d of dry natural gas and output will be very low sulfur diesel, naphtha and liquefied petroleum gas (LPG). A year ago in April 2012 the economics looked very positive because of the wide spread between gas prices and refined products but the margins have narrowed since then. Today we look at prospects for this plant and others like it.

Before we start – a quick disclaimer. RBN Energy does not advocate investment SASOL or any security, for that matter. We are not an investment advisor. The purpose of this article is not investment advice or an endorsement.

About a year ago in April 2012 we looked at GTL technology and plans by SASOL and Shell to build two plants in Louisiana (see Monster Mash) that would convert dry pipeline spec natural gas into refined petroleum products. As we explained then, the technology uses the Fischer-Tropsch process that involves a series of chemical reactions with the natural gas to first produce a synthesis gas and then various liquid petroleum products. The technology is not new and SASOL have been successfully running a 32 Mb/d plant in Qatar since 2007 that is currently very profitable.

The principal challenges to the GTL process are the cost of building the plant and the extent to which margins rely on a wide spread between refined product and natural gas prices. SASOL estimates that their proposed US GTL plant requires a capital investment in the range of $11B - $14 B. That is more than it costs to build a traditional oil refinery or a petrochemical cracker. A plant that costs that much money typically has a payback period for investors of at least 30 years. So the economics have to look beyond today’s price environment and consider the risk of a wide range of scenarios.

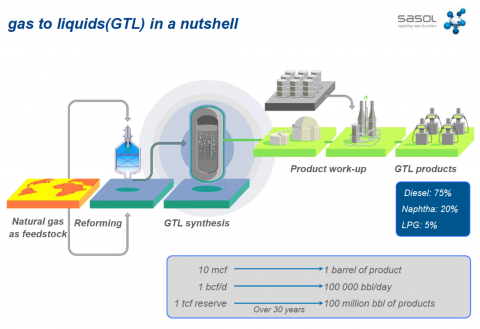

The diagram below is the latest plant layout from last week’s SASOL presentation. The plant will use roughly 10 MMBtu of natural gas to produce each barrel of petroleum products. Louisiana plant capacity is planned to be 96 Mb/d meaning that 1 Bcf/d of natural gas is consumed. The output for the first phase will be 75 percent diesel, 20 percent naphtha and 5 percent LPG (mostly propane). SASOL is also planning to diversify the plant output in a second phase to include base oils and paraffin that would be used to produce synthetic oils, wax products and linear alkyl benzene (LAB – used in the manufacture of surfactants).

Source: SASOL Investor Strategy Presentation (Click to Enlarge)

As we mentioned, the plant economics rely on the spread between the natural gas feedstock price and the value of the output products. The chart below shows the natural gas fuel cost (red line) and the estimated value of the output products (blue line) since the beginning of 2009. The further the two lines are apart, the more money the plant contributes towards fixed and variable operating cost (...theoretically, of course, since the plant does not exist yet). The data shows that the plant contribution would have been negative at the start of 2009 (the cost of natural gas was higher than the value of the products). Since then the potential contribution has grown larger. The average for 2009 was about $25/Bbl growing to an average of $75/Bbl in 2011 and $85/Bbl in 2012. The average for 2013 so far is still close to $85/Bbl but has fallen to $60/Bbl in the past month. The increasing plant contribution over the past two years has resulted from lower natural gas prices and higher refined product prices.

Join Backstage Pass to Read Full Article