Woodside Energy’s final investment decision (FID) on the $17.5 billion Louisiana LNG terminal was a stunner. For one thing, only 1 million metric tons per annum (MMtpa) of the project’s 16.5 MMtpa (2.2 Bcf/d) of capacity is under contract — U.S. LNG export projects typically have commitments for two-thirds or more of their output before pulling the trigger. The project will also have an outsized impact on gas flows in a region already struggling to keep up, and it may well upend plans for other projects in the works. In today’s RBN blog, we take a closer look at Louisiana LNG, Woodside’s daring development approach, and the terminal’s impacts on gas demand, gas flows and pre-FID projects.

In observance of today’s holiday, we’ve given our analysts a break and are revisiting our recent blog on Woodside and its Louisiana LNG terminal. If you didn’t read it then, this is your opportunity to see what you missed. Happy Memorial Day! And a sincere thank you to the men and women who made the ultimate sacrifice while fighting for our freedom.

Australia’s Woodside Energy announced April 28 that it will establish its LNG foothold in the U.S. by building Louisiana LNG, a project the company acquired in October 2024 when it purchased the nearly bankrupt Tellurian — and its Driftwood LNG project — for $900 million. Driftwood LNG came close to becoming a reality more than once, only to crash, burn and be rebranded. Now, with a new owner and name, the three-train terminal just south of Lake Charles will be built, with first LNG expected in 2029 and its full capacity online in 2031. Since the FID, Woodside has requested an eight-month extension from the Federal Energy Regulatory Commission (FERC) to complete construction on the first phase by December 31, 2029.

We’ll get to Louisiana LNG’s physical particulars in a moment but first let’s look at Woodside Energy and the seemingly audacious decision by the company and its project partner — Stonepeak, the New York City-based investment firm — to take FID on an 11-figure project with less than one-sixteenth of its output under long-term contract. (For a detailed look at North American LNG export activity and infrastructure developments, see the recently published quarterly edition of our LNG Voyager report.)

Woodside Energy

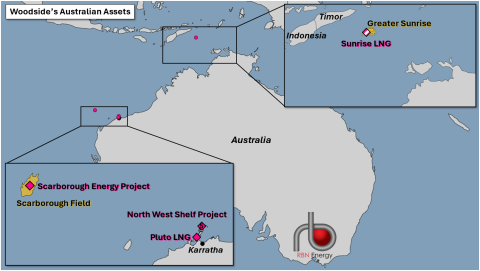

Woodside is Australia’s largest independent oil and gas company and operates primarily offshore; it is also an international LNG supplier. The company expects to produce up to 537 Mboe/d in 2025, with about 40% of that to feed its LNG terminals (~1.25 Bcf/d), another 20% as pipeline gas (~623 MMcf/d) and the rest as oil (~215 Mb/d). The company operates two LNG terminals in Australia. One is the North West Shelf Project (NWSP; magenta diamond with No. 5 in left inset of Figure 1 below), which produces gas for domestic consumption and LNG export. NWSP has five trains with a total capacity of 16.9 MMtpa (2.2 Bcf/d). Woodside also operates Pluto LNG (magenta diamond at bottom right of left inset), a single-train, 4.9-MMtpa (0.65 Bcf/d) export terminal. An 8-MMtpa (1.1 Bcf/d) expansion is underway, with first LNG expected in 2026. The expansion is part of the Scarborough Energy Project (magenta diamond at left in left inset), which also includes development of the Scarborough Field (gold-shaded area) in the Carnavorn Basin off the coast of Western Australia. Woodside is also part of the Sunrise LNG project in the Timor Sea (between East Timor and Australia; striped magenta diamond in right inset), which is still pending development agreements.

Figure 1. Map of Woodside’s Australian Assets. Source: RBN

Join Backstage Pass to Read Full Article