Could the construction of new production capacity for one chemical product result in a 1.4 Bcf/d increase in natural gas demand? Yes it could - if all the methanol plants that have been announced and are on the drawing board get built. Of course, it is pretty unlikely that they will all get built, but even if only the best projects are completed, they will still consume a lot of gas. Today we’ll lay out the new plant construction numbers.

|

Check out Kyle Cooper’s weekly view of natural gas markets at |

The U.S. Methanol Market

During the 1980’s and 1990’s the United States was the largest methanol consuming and producing country in the world. Now that distinction goes to China with approximately 26 million tons of methanol production in 2012. But the US is making a comeback. As a result the methanol industry is becoming a significant player again in US natural gas consumption.

Prior to the sharp increases in natural gas prices in the late 1990’s and early 2000’s, the US had approximately 10 million metric tons of methanol capacity, consuming about 0.9 Bcf/d of natural gas. By the end of 2005, US methanol capacity had been reduced to approximately 785 thousand tons per year, about 8 percent of its former peak. The US demand for methanol was met from imports. That’s about to change. If all of the planned methanol capacity growth in the US materializes, we could see more than 16 million metric tons of new methanol capacity, which would consume an incremental volume of more than 1.4 Bcf/d of natural gas.

Methanol is a basic building block for many chemicals with formaldehyde, acetic acid and MTBE (for export) being the three major consumers of methanol in the US. Methanol has also become a major feedstock for olefins production in China. More than 7 million metric tons per year of methanol is blended into gasoline each year in China. Small volumes are used as high performance race car fuel.

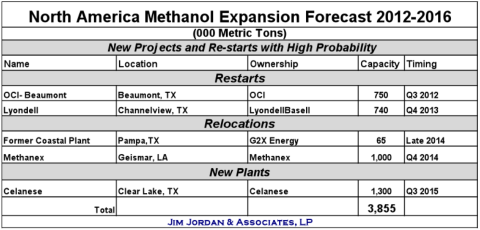

It is well known in the methanol industry that a number of new, relocated and restarts of methanol plants in the US have been announced. There are also a number of projects under evaluation that have not been announced publically. The list might be surprising to some, but below are the projects that are underway, announced or unannounced. Capacities are nameplate and may not be the exact production capability. The first table includes the OCI integrated methanol and ammonia plant which re-started last year and others that are on our highly probable list. Lyondell applied for permitting last year and current plans are to have the plant operational in early Q4 of 2013. The G2X Energy plant in the first table is beginning construction immediately with completion planned for Q2, 2014. The Methanex plant relocation from Chile in the first table is scheduled to start up in Q4, 2014. Permitting has been approved and it would not be surprising to us to see the plant operational ahead of schedule. This plant was fully operational in Chile. Last week (January 2013) it was announced that Methanex and Chesapeake Energy signed a 10-year agreement under which Chesapeake will supply natural gas to the project under terms which include linking gas pricing to the methanol selling price. Of the projects listed in this first table, the one that we have not confirmed recently is the Celanese plant. In their original announcement, the plan was to have the plant up in mid-2015. We know permits have been applied for, but do not have a recent update.

(Click to Enlarge)

The next table includes some plants that have been announced and others that have not. We will not elaborate a lot on these since they are in various stages of planning and some prefer to keep their plans confidential until they are ready to make announcements. First lets take a look at the announced plants in the top half of the table. We can say that the Zero Emissions Energy Plants (ZEEP) project is under serious consideration by the developers and in discussions with them we see the potential for this project to go forward, but still quite a ways to go before we would move it to the probable list. They do have financial backing. The Lake Charles Clean Energy project (owned by Leucadia) has momentum with significant milestones already achieved. The project is integrated with numerous products in addition to methanol and an off-take agreement for the methanol has been reached with BP. The methanol plant would use petroleum coke (“petcoke”) as a feedstock and would be the first of its kind in the US. An agreement has been reached for petcoke supply.

(Click to Enlarge)

The Moss Point project (also owned by Leucadia) is not as far along in development as the Lake Charles Clean Energy project, but is a viable project that could take a couple of different directions, including possibly the use of methanol as a precursor for the manufacture of motor gasoline. Similarly, the recently announced G2X Energy project would feed a Methanol to Gasoline (MTG) plant that would be constructed adjacent to the methanol plant. The relocation of a 2nd Methanex plant from Chile is under consideration and a decision is expected by Q3 of this year.

The next group of projects has not been publically announced, but some are every bit as viable as those that have been announced (bottom half of the table). While we are not authorized to name the developers, we are in contact with these entities and can say that some are quite serious. The fourth project in the unannounced list, another relocation project (472 KTA) is highly probable in our opinion, but as yet the developer has not made an official announcement. The others are all in various stages of planning and we expect to hear some announcements later this year.

When we add up the potential US capacity (that we know about), the total is almost staggering, exceeding 16 million metric tons. To put this into perspective, one million tons of methanol consumes about 32 million btu’s of natural gas. So to convert that to a daily gas supply multiply the addition in metric tons (16) times the gas per metric ton factor (32), then divide by 365 to get the gas number on a daily basis

16 * 32 = 512 / 365 = 1.4 Bcf/d.

Certainly, all of these projects will not be built and in the supply demand projections that we provide to clients, we reflect that. However, we caution our consumer clients that we do not believe there will be a glut of methanol. On a global basis, we actually expect methanol supply to get much tighter than it is today. Regions with abundant gas are moving more to LNG for better returns and China’s expansion into various downstream chemical markets requires far greater supplies of methanol than is currently available. This demand growth is so dynamic that we cannot quantify it until we have better market intelligence. But we are confident that the growth in the methanol market, including the use of methanol to produce olefins (like ethylene and propylene) during the remainder of this decade will be faster than has been seen in recent years.

Methanol is a 1998 tune from Izzy Stradlin, former guitarist of Guns N’ Roses, on the album 117°.

|

Each business day RBN Energy releases the Daily Energy Post covering some aspect of energy market dynamics. Receive the morning RBN Energy email by signing up for the RBN Energy Network. |