In Texas, rising power demand, increasing dependence on variable-output renewables, and declining availability of dispatchable fossil-fired plants to back up wind and solar have left the Electric Reliability Council of Texas (ERCOT) power grid in a pickle. As part of its response, the Public Utility Commission of Texas (PUCT) adopted a tool called the Performance Credit Mechanism (PCM) to help ensure the grid will be able to meet a yet-to-be-defined reliability standard. But while key metrics for the PCM have been identified, the details will determine which dispatchable resources will be supported with additional revenue, how much the whole approach will cost, and how effective it might be. In today’s RBN blog, we explore the debate ahead of the PUCT’s August 29 meeting — where it is expected to finalize rules around the PCM — and explore the difficulty of compensating generators annually so that they are also there for those once-in-10-year events.

We’ll get into the details around the PCM in a bit, but let’s start with a little background. Before power market deregulation picked up steam in Texas and elsewhere in the 1990s and 2000s, the regulated utilities’ primary focus was grid reliability. Utilities that distributed electricity also generated most, if not all, of their power and collected revenue based on a regulated return on investment. The dawn of deregulation promised lower energy prices by allowing market forces to increase efficiency. Regulated utilities still deliver the power, but independent power producers compete to provide the lowest-cost energy in deregulated markets and in many states newly formed electricity retailers were allowed to compete to provide the power the utilities distributed.

ERCOT, which manages about 90% of the electric load in Texas, is different in that it has an energy-only market, where electricity generators — including nuclear units, coal plants, gas plants, wind farms and solar facilities — are paid only for the energy they provide. In most other U.S. grids, generators also receive payments for the capacity they promise will be available when it’s needed.

Over the past 20-plus years, ERCOT has also become home to scores of large, tax-incentive-supported wind farms and, more recently, large-scale solar facilities — all of them connected to the grid with thousands of miles of renewables-focused transmission lines. Once built, wind and solar can offer energy at remarkably low prices, but come with a couple of catches. One is that the wind doesn’t always blow, and the sun doesn’t always shine. The other is that the ready availability of inexpensive renewable energy when the wind is blowing and the sun is shining threatens the profitability of dispatchable sources of energy like coal- and natural-gas-fired power plants, whose energy output can reliably ratchet up and down when wind and solar underperform and/or demand is high, particularly during winter storms.

We should note that electricity is unlike other commodities. Electricity markets must be balanced not on an annual, monthly, or even a daily basis — instead, grid operators need to balance supply and demand every few seconds. In deregulated markets like ERCOT, grid operators utilize ancillary services that pay generators to be on call to produce electricity (or reduce output) when there is a sudden imbalance in supply and demand caused by, say, a forced plant outage or a weather-related change in wind or solar output.

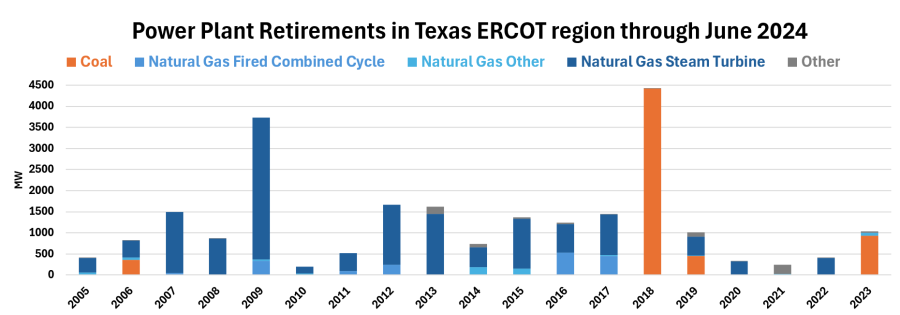

Over the years, increased renewable capacity in ERCOT — coupled with other factors, such as rising environmental-compliance costs— have challenged the profitability of many less-efficient plants fired by coal (orange bars in Figure 1 below) and natural gas (blue-shaded bars), causing them to retire as they were unable to cover their operating costs (labor, fuel and maintenance), a topic we discussed in Electric Avenue. The production tax credit (PTC) for renewable sources of generation has also been a factor in the rate of power plant retirements. (Texas leads the U.S. in wind power capacity, with more than 40,500 MW installed, and is second in solar generation at about 32,000 MW.)

Figure 1. Power Plant Retirements in Texas ERCOT Region Through June 2024. Source: EIA

Join Backstage Pass to Read Full Article