Negative natural gas prices have been breaking hearts in the Permian Basin for many years, with pipeline development struggling to keep pace with rapid increases in associated gas production, but 2024 has shattered all previous records for the severity and length of negatively priced periods. The Matterhorn Express Pipeline, which started partial service at the beginning of October, is helping to stabilize the market for now, but with more production gains on the way, additional takeaway capacity will be needed. And after this year’s run of negative prices, producers have been willing to commit to new capacity.

In observance of today’s holiday, we’ve given our writers a break and are revisiting a recently published blog on the Permian Basin and the Hugh Brinson Pipeline. If you didn’t read it then, this is your opportunity to see what you missed! Merry Christmas!

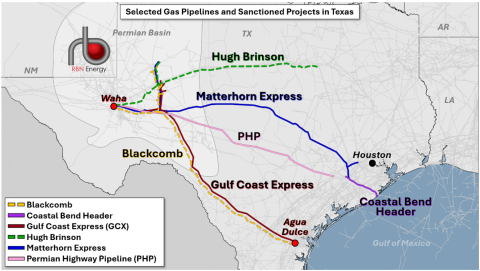

A whopping 4.57 Bcf/d of new pipeline capacity has secured final investment decisions (FIDs) since this summer, including two new greenfield pipelines — WhiteWater Midstream’s 2.5-Bcf/d Blackcomb pipeline took FID in August 2024, and then last week, Energy Transfer sanctioned the Hugh Brinson Pipeline, which will provide at least 1.5 Bcf/d of additional takeaway capacity. The incremental capacity provided by these projects will be needed soon, as our forecasts indicate a strong likelihood that capacity constraints will return in the early months of 2026. In today’s RBN blog, we discuss Energy Transfer’s newly renamed Hugh Brinson Pipeline — formerly the Warrior Pipeline — and other recent developments in the Permian and examine how they will reshape flows and basis throughout the wider region.

The first nine months of 2024 gave as clear a demonstration as has ever been seen of what happens when gas production rises to the point that takeaway capacity out of the region is insufficient. This includes a streak of 39 days between late July and early September where Waha cash prices were negative, according to data from Natural Gas Intelligence (NGI). During that streak, Waha cash averaged minus $1.74/MMBtu, including a record nadir of minus $6.41/MMBtu on the long Labor Day weekend. Over the nine-month period, the outright price of natural gas at Waha (the main gas pricing hub in the Permian) was negative for more than 43% of all trading days. During those days of negative pricing, Permian producers who were not bound by long-term contracts were paying to have their gas taken away. In a gas-focused region like Appalachia and the Haynesville, this would have brought drilling-and-completion work to a halt. However, even with negative gas prices, Permian producers that are exposed to spot prices still bring in ample revenue from crude oil and NGLs, and ramped-up deterrence on flaring gives them no real choice but to pay to have someone take their gas off their hands — a phenomenon we have documented in the NATGAS Permian Report.

Figure 1. Selected Gas Pipelines and Sanctioned Projects in Texas. Source. RBN

Join Backstage Pass to Read Full Article