Growing propane production from the NGL surge is building up inventories and pushing down prices because it can’t reach markets where demand is increasing. That story probably sounds familiar to crude and natural gas producers actively looking for opportunities to export their way around production overhangs. However, unlike crude and natural gas (or condensate) there are no regulatory barriers to prevent US propane exports. Today we look at how exports will balance growing supplies in the propane market.

Increased Propane Supply

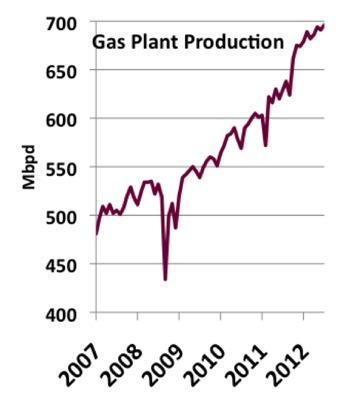

Propane is one of the 5 purity natural gas liquid (NGL) products that are produced by fractionating y-grade or raw mix. The y-grade is extracted from natural gas in processing plants before the dry gas is shipped to customers (see the Long and Winding Road blog series – Part I and Part II). Along with the other NGLs, propane production has increased rapidly over the past five years. Propane has jumped by 200 Mb/d over the past 5 years (see chart below). The NGL production boom results from increased natural gas shale production over the same period. A decline in the ratio of natural gas prices to crude oil encouraged natural gas producers to drill “wet” gas plays (that contain more NGLs) to increase their internal rates of return. NGLs are more valuable to gas producers because they are priced against crude. NGL fractionation is increasing and significant new fractionation capacity is being added (see Can Mont Belvieu Handle the NGL Surge?). NGL growth is occurring in the Northeast – home of the Marcellus and Utica natural gas basins and Mont Belvieu,TX - home of the world’s largest fractionation complex. Oil refineries also produce propane but that output is flat in the face of reduced demand for refined products in the US.

Source: EIA

Propane Demand

As we discussed in our Carbon Rich – Value High blog series on NGL supply and trading (see Part I, Part II and Part III) each of the purity NGLs – propane, butane, ethane, natural gasoline and isobutane have unique markets and value although there is some crossover in their use. We covered propane in Part II – learning that more than half of propane supply is consumed for domestic cooking and heating and that consumption during the winter heating season exceeds production capacity. The petrochemical market consumes about 40 percent of propane as a feedstock for ethylene plants (“crackers”) or propane dehydrogenization (PDH) plants that produce propylene. Propane competes with ethane as a feedstock for ethylene crackers as we explained in our series on petrochemical margins (see Let’s Get Crackin - How Petrochemicals set NGL Prices – Part IV). If propane margins are higher than ethane then those ethylene plants that have the flexibility to switch feedstocks will use propane. When ethylene crackers use ethane they produce minimal propylene as a byproduct. That creates more demand for propylene from PDH plants that consume propane.

Join Backstage Pass to Read Full Article