A week or so ago in Part IV of the Marcellus Changes Everything series, we noted that by 2016 there would be a summer surplus of natural gas production from the Marcellus of around 3 Bcf/d. We pointed to Dominion’s Cove Point LNG proposed export terminal on the Chesapeake Bay as one likely outlet for the surplus. Dominion’s proposal is one of 14 LNG terminals being reviewed by the government for an export permit. Today we investigate how many of these terminals will be built and whether the natural gas markets sustain can such a high level of exports?

Cove Point Facility

We start by looking more closely at the Cove Point project that is currently awaiting Department of Energy (DOE) approval for exports to countries without Free Trade Association (FTA) agreements with the US (that list includes most countries having significant LNG demand). If the DOE approves Dominion’s application, the company expects to begin exports in the third quarter of 2017, by which time Marcellus production should be comfortably eclipsing local demand.

Dominion is proposing to construct facilities for exporting liquefied natural gas (LNG), at its existing Dominion Cove Point LNG Terminal located on the Chesapeake Bay in Lusby, Md.

Cove Point was built as an LNG import terminal in the 1970’s and received ship-borne Algerian LNG imports from 1978 to 1980 before being mothballed after import costs became uneconomic. During the 1990’s Cove Point was converted to a storage facility. In 2003 LNG imports to Cove Point resumed as US gas supplies once again lagged behind demand making imports economic. Lower natural gas prices in the past two years following increased US domestic production from shale once again resulted in those imports drying up last November (2011).

Liquefying natural gas allows it to be stored and transported more efficiently. In its liquid state, 600 standard cubic feet of natural gas take up only 1 cubic foot of space, making it economical to transport between continents in specially designed ocean tanker ships. The process of liquefaction requires lowering the temperature of the gas to -2630 F. Known as “trains”, large scale liquefaction plants represent seriously huge investments costing anywhere from $2-$8 Billion (MIT estimate).

Once built, Cove Point liquefaction capacity will be 5 Million metric tones per year (MMtpa) or 0.75 Bcf/d and the company has already contracted half of that volume to Japanese trader Sumitomo and utility Tokyo Gas. Sumitomo has an existing interest in Marcellus gas production as 30 percent owner of Rex Energy Drilling as well as a similar interest in the Barnett Shale. The Japanese firms have a precedent agreement (PA) in place with Dominion for 20-year supply of 2.3 MMtpa or 0.35 Bcf/d of LNG from Cove Point. We don’t know the pricing mechanism.

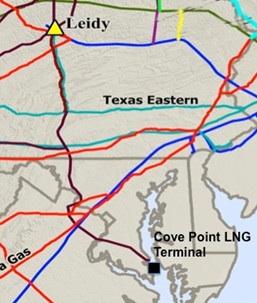

For other customers, Dominion says that it will structure their capacity contracts as tolling arrangements – converting natural gas to LNG for a fixed fee expected to be around $3/MMbtu. The Cove Point Terminal is connected via its own pipeline to the major Mid-Atlantic gas transmission systems of Transcontinental Gas Pipeline, Columbia Gas Transmission and Dominion Transmission via the Leidy natural gas trading and storage hub in Pennsylvania (see map below). The Cove Point facility also has storage capacity of 14.6 Bcf.

Join Backstage Pass to Read Full Article