A first-of-its-kind frac sand logistics solution set to debut in the Permian Basin later this year may help transform the way proppant is delivered to support hydraulic fracturing operations there. If it works as advertised, it will represent another advance in the streamlining of oil and gas production in the U.S.’s most prolific shale play. In today’s RBN blog, we‘ll explore how Atlas Energy Solutions aims to mechanize the delivery of sand to crude-oil-focused well sites in the Permian.

Before we delve into Atlas’s innovation, it’s important to understand the critical role sand plays in the Permian’s Delaware and Midland basins. Hydraulic fracturing is, of course, a transformative process used to extract oil and gas from shale formations deep underground. One essential component of the process is proppant, typically mined sand, which is injected with water and carefully selected chemicals into wells under high pressure to “prop” open fractures in the rock and allow the hydrocarbons to flow to the surface.

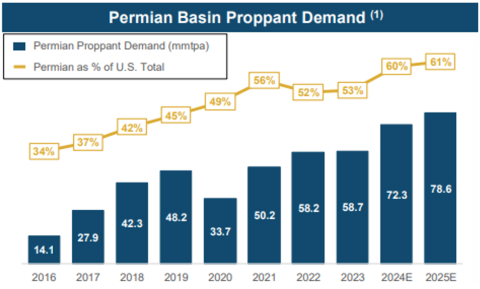

As we all know, the Permian is driving U.S. shale production growth. RBN’s mid-case production forecast has Permian output growing from 10.4 MMboe/d in 2024 to 11 MMboe/d in 2025 — a 6% annual growth rate — and more production means more proppant. And lots of it: Many thousands of tons of sand — often 10,000 or even 15,000 tons! — are used per well in West Texas and southeastern New Mexico. [There is a lot of variability in frac sand use, depending on, among other things, the type of frac job (zipper frac vs simul-frac), the horizontal length being drilled, the pressure of the well, and many other factors. In a zipper frac, two wells are completed in an alternating, back-and-forth manner. In a simul-frac, two wells are stimulated at the same time.] Permian proppant demand grew from just over 14 million tons per year in 2016 to nearly 60 million tons last year, and it’s estimated to grow to almost 80 million tons by 2025 (see blue bars in Figure 1 below). The Permian is also making up an increasingly large share of total U.S. proppant demand, rising from 34% in 2016 to 53% in 2023 and (by recent estimates) to about 60% this year and next (gold line and boxes in Figure 1).

Figure 1. Permian Basin Proppant Demand. Source: Atlas Energy

Join Backstage Pass to Read Full Article