Natural gas prices at the Waha Hub in West Texas have been below zero for going on two weeks — that’s outright negative cash prices, not basis, which means Permian producers are literally paying to have their gas taken away. Ample supply along with weak demand have prompted an early start to the injection season this year and are putting downward pressure on U.S. gas prices more broadly. But why all the craziness now? One of the best ways to get a handle on the Permian gas-market meshugah is to examine gas pipeline flows within the basin and without, which, as it turns out, is the focus of our upcoming School of Energy Master Class. Today's RBN blog is a blatant advertorial for that event where we’ll be discussing gas-flow analysis, pipeline modeling and how they help explain why Waha gas prices have gone sub-zero.

At first glance, nothing extraordinary jumps out about what’s happening in the Permian to depress Waha prices. Permian supply is in line with or lower than where it has been all winter, except for during the mid-January freeze-offs. Is it pipeline maintenance? Weirdly low demand? We’ve dug into it and determined that no single driving factor or event is to blame for the recent run of negative prices. Instead, it’s a combination of low demand (both within the basin and without), as well as pipeline work along several key routes, including El Paso Natural Gas (EPNG) and some of the newer greenfield pipelines headed east out of the basin. And it looks like these overall dynamics will keep downward pressure on Waha prices throughout the spring, meaning we likely haven’t seen the last — or lowest — of negative prices in the basin this year. Yikes!

Negative gas prices for weeks or even months in a market as massive and important as Waha is a big deal, so it’s worth taking a look under the hood and getting our hands dirty to see what’s going on. For now, let’s focus on just a couple of the key factors at play: namely, gas flows within the Permian and from there to the U.S. West Coast. By using pipeline flow analysis — which you can learn to do on your own at our April 10 Master Class — we can unpack the impact of the ongoing EPNG system maintenance on both the West Texas and California markets to reveal part of the puzzle of why Waha prices are negative now and how long this price pressure might persist.

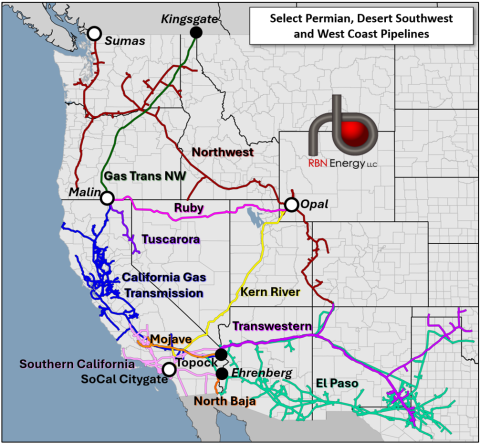

Maintenance on EPNG (light-green lines in Figure 1 below) has been intermittently disrupting flows from the Permian to the California border for some time now, and who feels the pain depends on what else is happening in both regions. Last fall, these flow disruptions were a bigger deal for California than they were for the Permian, but currently it’s the Permian that’s feeling the heat.

Figure 1. Select Permian, Desert Southwest and West Coast Pipelines. Source: RBN

Join Backstage Pass to Read Full Article