Earlier this month, US Midstream logistics firm Targa pulled out of a crude by rail marine dock project at the Port of Tacoma, WA. The plan was to rail crude from the Bakken to barges and tankers for shipment to refineries in Washington State and California. Other rail projects in California like the Valero Benecia terminal have been delayed by permitting issues. Some folk are questioning whether these setbacks mean that crude- by rail to the West Coast has gone off the boil. Today we begin a two part review of West Coast rail prospects.

Targa planned to use the Port of Tacoma site to build a rail yard and tank farm to receive 100 car unit trains with crude oil from the Bakken as well as biofuels such as ethanol and biodiesel. The facility would have provided marine barge and tanker loading to ship fuels to Puget Sound and California refineries. Targa was apparently unable to identify an “economic path forward for the project” and terminated their lease. Targa also dissolved an agreement with Phillips 66 to deliver 30 Mb/d of crude to that company’s Ferndale, WA refinery that would have been shipped through Tacoma.

|

Check out Kyle Cooper’s weekly view of natural gas markets at |

Not being privy to Targa’s internal analysis of their project, we can’t say for sure why they got cold feet. Our analysis indicates that there are still plenty of crude by rail terminals being built on the West Coast and we will update the status, timing and expected capacity of those terminals in Part 2 of this series. First though we take a look at how the economics of moving crude to the West Coast by rail have changed since the start of 2013. We looked at those economics in April (2013) when we surveyed crude by rail (see West Coast Destinations). In that analysis we noted a growing number of rail terminals in the Northwest designed to feed Puget Sound area refineries as well as a smaller number of terminal plans developing to feed California refineries. Most of those terminals were being developed with the idea of shipping Bakken crude from North Dakota by rail to the West Coast.

For Bakken producers and shippers, the economics of moving crude from North Dakota to the West Coast by rail are governed by the price spread between Bakken crude and the West Coast benchmark Alaska North Slope (ANS). So far this year those economics have been favorable.

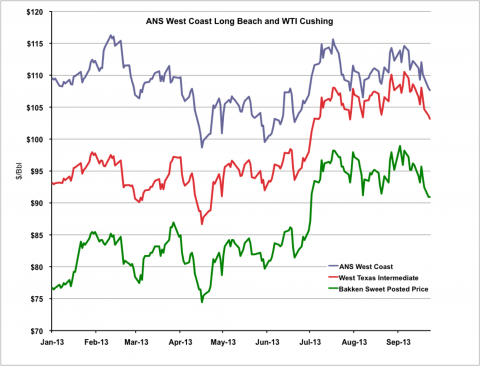

The chart below shows crude prices this year for ANS sold on the West Coast (at Long Beach CA), posted prices for Bakken light sweet crude in North Dakota and prices for West Texas Intermediate (WTI) – the benchmark Midwest crude at the Cushing, OK trading hub. You can see that the ANS price (purple line) is the highest, with WTI (red line) in the middle and the Bakken posting (green line) at the bottom. Bakken posted prices are set by crude gatherers in North Dakota at a discount to WTI at Cushing (see The Bakken Buck Starts Here). ANS prices are set by international competition to supply refineries on the West Coast as well as the relative price of California grades (see After The Oil Rush). Although differences between the qualities of these crudes are also important influences on their price, rail movements generally become economic when ANS premiums to Bakken postings are sufficient to cover rail transport costs from North Dakota to the West Coast. And that has been the case throughout this year so far. The average ANS premium to Bakken postings year to date (September 24, 2013) was $22.49/Bbl and the average in September was $16.31/Bbl. Our conservative estimate of rail shipment costs from North Dakota to Washington State (including gathering and terminal fees) is $15/Bbl. A Bakken producer would have received an additional ($16.31 - $15) or $1.31/Bbl more to ship their crude to the West Coast in September or an average ($22.49 - $15) or $7.49/BBl year to date.

Source: Alaska Department of Revenue, Plains Crude Posting (Click to Enlarge)

The US crude market evolved considerably this year as the WTI discount to coastal crudes such as ANS narrowed from $16/Bbl in January to $4-$5/Bbl today. That narrowing discount reflected the unwinding of a supply logjam in the Midwest that pushed WTI prices down relative to coastal crudes like ANS. Nevertheless the economics of shipping crude to the West Coast remained favorable. When we did the math in July - calculating netback prices for crude from North Dakota to the East, West and Gulf Coasts as well as Cushing, the results showed that netbacks for sending crude by rail to the West Coast were second only to shipping to the Gulf Coast by pipeline (see Netback, Netback, Netback to Where You Started From).

Join Backstage Pass to Read Full Article