Gulf Coast LPG export capacity is tight again, and it’s going to get worse before it gets better — terminal capacity to load more barrels of propane and butane simply has not kept up with production gains. A number of new LPG dock expansions and greenfield projects are in the works, but they are 18 months or so away. In the meantime, production keeps rising, inventories are high, and it’s very unlikely we will see enough cold weather to balance the propane market. Bottom line: 2024 is shaping up to be a tough year for propane and butane prices. In today’s RBN blog, we examine what has been happening with exports, the looming dock capacity constraints, and the projects that will eventually relieve the imbalance.

NGL export markets are a frequent topic in the RBN blogosphere, especially when LPG export capacity gets tight — such as the first round of export capacity constraints in 2012-16 when shale production was just kicking in, and then again in 2019-20. This year we’ve posted a number of blogs that considered the impact of increasing NGL production and the implications for exports. In Ready For It? we looked at what increases in Permian NGL production has meant for mixed NGL (aka Y-grade) takeaway capacity out of the basin — the market needs a lot more. Then, in in It's A Mystery, we questioned why, with all the new gas processing plants coming online, NGL production wasn’t growing even faster. (That mystery was solved as production statistics ramped up during the second half of the year.) We also examined the implications of surging ethane production and the implications for much higher ethane exports in You Ain't Seen Nothin’ Yet.

It’s been a crazy market for NGLs this year. Total production from gas plants and refineries will hit an astronomical 7 MMb/d in 2023, up 1 MMb/d from the 6 MMb/d average in 2021. But while supply is increasing, domestic demand for NGLs has been essentially flat. The implication is obvious: more exports. Almost all incremental production volume is destined to move to exports, with the lion’s share — about 85% — moving off the Gulf Coast. Fortunately, global markets have been more than receptive to receive growing, attractively priced U.S. export volumes.

LPG markets — propane and butane — have been at the epicenter of that surge in Gulf Coast NGL exports. If you are not familiar with LPG exports, here’s a quick tutorial. Propane and butane (together called LPGs or liquified petroleum gases) are exported across the same dock facilities and are frequently exported together on the same ship, although in separate tanks, not mixed in an LPG cocktail. Since they are exported at the same time, the dock capacity used is the sum of the propane and butane loaded on a ship. However, the capacity available is different for propane versus butane. That is because while both products must be chilled before being load onto the LPG workhorse ship, called a Very Large Gas Carrier or VLGC, propane must be chilled to a much lower temperature than butane. The colder the temperature needed, the more chilling capacity is required. Therefore, the capacity of the chiller is frequently a limiting factor for determining effective LPG export capacity for a terminal.

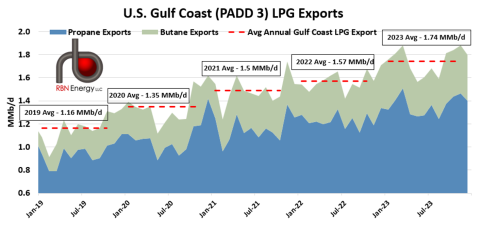

As shown in Figure 1, LPG exports were strong in 2019, with volumes out of PADD 3 (Gulf Coast) export terminals averaging 1.16 MMb/d (dashed red line to far left), representing a year-on-year gain of 13% (130 Mb/d). Despite Covid-19, 2020 was a banner year for LPG exports, with volumes up 16% (188 Mb/d) to 1.35 MMb/d as new dock export capacity was added. Growth slowed from that point, however, with shipments up 10% (139 Mb/d) to 1.5 MMb/d in 2021 and only 5% (81 Mb/d) to 1.57 MMb/d in 2022 as the global LPG market waited on new petchem and other demand, mostly in China, to ramp up. But 2023 has been another big year, with RBN’s projected export volumes coming in at 1.74 MMb/d - up 172 Mb/d (or 11%) from last year.

Figure 1. U.S. Gulf Coast (PADD 3) LPG Exports. Sources: EIA, RBN NGL Voyager

Join Backstage Pass to Read Full Article