Buoyed in part by early optimism about the Trump administration’s potentially positive impact on the economy and the oil and gas industry, the WTI spot oil price reached a five-month high of nearly $76/bbl in January. But the optimism and oil prices have steadily eroded due to the impact of tariffs, trade wars and stubborn oilfield service inflation. In today’s RBN blog, we’ll look at the impact of the January price spike on Q1 2025 earnings and analyze the potential impact of a much lower price scenario in Q2 2025.

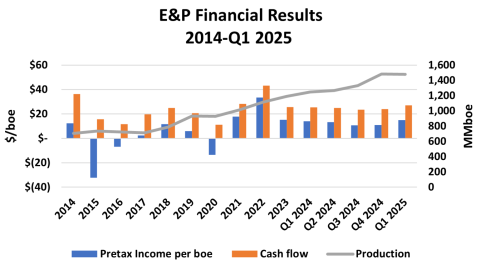

The strong January spot price drove the Q1 2025 average to $71.83/bbl, up 2% from a three-year low of $70.32/bbl in Q4 2024. However, a nearly 70% increase in natural gas prices during the quarter drove a 9% increase in the average oil and gas price to $38.91/boe, the highest since Q1 2023. As a result, the earnings for the 40 E&Ps we cover totaled $22.1 billion in Q1 2025, up 37% to $14.96/boe (blue bar to far right and left axis in Figure 1 below), up from $10.89/boe in Q4 2024. Cash flow grew to $40.1 billion, increasing 13% to $27.15/boe (orange bar and left axis) over the same time period.

Figure 1. E&P Financial Results and Production, 2014-Q1 2025.

Source: Oil & Gas Financial Analytics, LLC

The quarter-over-quarter increase in performance appears less impressive when viewed from a broader historical perspective. Average commodity prices for the quarter most closely parallel the results in Q3 2021, when the WTI spot price was just under $71/bbl and the average Henry Hub spot price was within $0.20 of the Q1 2025 price at $4.35/MMBtu. While the average realization in Q3 2021 was just $1.83/boe higher, the pre-tax operating income was $20.42/boe, 36% higher than the recently completed quarter. A major factor is a $2/boe increase in production costs over the last three years, driven by significant post-pandemic oilfield equipment and services inflation. Depreciation, depletion and amortization (DD&A) costs were also more than $1/boe higher, reflecting the higher costs of finding and acquiring reserves. Persistently higher costs are likely to exacerbate the impact of lower commodity prices in Q2 2025 and beyond.

The comparison of costs for Q1 2025 over the previous quarter is more positive. Lifting costs grew 2% to $11.77/boe as production costs increased 2% to $9.86/boe and production taxes rose 7% to $1.90/boe. DD&A expenses declined 3% to $10.92/boe, while impairment charges fell 40% to $0.96/boe. Exploration outlays were down 9% to $0.30/boe.

Join Backstage Pass to Read Full Article