Strategic Petroleum Reserve (SPR) inventories have been climbing for more than a year, but they could go much higher if President Trump has his way, as one of his major campaign promises was to refill the SPR “to the very top,” a goal he has repeated since his return to the Oval Office. Current inventories sit just below 400 MMbbl, leaving the SPR about 320 MMbbl shy of maximum capacity. But the refilling process may not be as straightforward as one might think, as three of the four SPR storage sites have experienced construction upgrades in the last year — which means things could go slower than anticipated. In today’s RBN blog, we’ll discuss the challenges of filling up the SPR and detail four scenarios for how the process might play out.

The SPR, the world’s largest emergency crude oil stockpile, was established in 1975. The first barrels were added in 1977, four years after Arab members of producer cartel OPEC cut off oil flows to the U.S. after it provided aid to Israel during 1973’s Yom Kippur War. At that point, the U.S. was heavily dependent on Middle East crude for use at domestic refineries, and some of you may remember idling in your cars in long lines at gas stations in hopes of getting a few gallons. The reserve aimed to bolster energy security and meet the nation’s pledges with the then three-year-old International Energy Agency (IEA). According to a 1974 agreement, IEA members must hold stocks equivalent to at least 90 days of net oil imports, based on the previous year’s annual average.

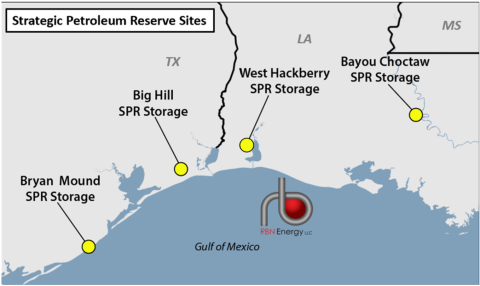

As shown in Figure 1 below, the federal crude oil storage program (see It’s All Coming Back To Me Now) is located at four sites: Bryan Mound and Big Hill in Texas and West Hackberry and Bayou Choctaw in Louisiana. Oil is kept in underground salt caverns — 61 in all — with a total authorized capacity of 714 MMbbl. According to the Department of Energy (DOE), the crude oil reserve is always drawdown-ready, which means it can release barrels to the market within 13 days of presidential direction. (That is the time needed to conduct the sale/exchange process, award contracts, and arrange the logistics for oil transportation. The DOE estimates an additional 6-8 days of transit to ship barrels to PADD 1 and 16-18 days to ship barrels to PADD 5, with pipeline connections to PADD 1, PADD 2 and the rest of PADD 3.)

Figure 1. Strategic Petroleum Reserve Sites. Source: RBN

Join Backstage Pass to Read Full Article