Is the glass half-full or half-empty? The answer to that age-old question usually indicates whether a particular situation is a cause for optimism or pessimism. That question is particularly appropriate when trying to place in perspective the cyclical movement of the earnings and cash flows of U.S. exploration and production (E&P) companies, including returns that have steadily declined with commodity prices over the last year. In today’s RBN blog, we analyze Q2 2023 E&P earnings and cash flows and provide some perspective on the past and future profitability of U.S. oil and gas producers.

In Q2, earnings and cash flows for the 42 U.S. E&P companies we cover declined for the fifth consecutive quarter to $16.7 billion ($12.18/boe) and $31.4 billion ($22.95/boe), respectively. The results, a two-year low, essentially matched the $12.29/boe profit and $22.95/boe cash flow recorded in Q1 2021, when oil and gas producers were just beginning to recover from the market shocks of COVID. From a short-term perspective, the results of the recent quarter look like cause for concern. But remember that the song title we used in our review of Q1 2021 earnings was Walking on Sunshine — relative to the previous quarters, E&P results were great. That quarter marked a dramatic turn in fortune as the industry recovered from $84 billion in first-half 2020 losses after the onset of the pandemic. It also represented the highest pre-tax earnings in the last decade, surpassing the $10.58/boe recorded in 2014, when oil prices topped $100/bbl. Cash flow was also the second highest in the last decade, topped only by 2014.

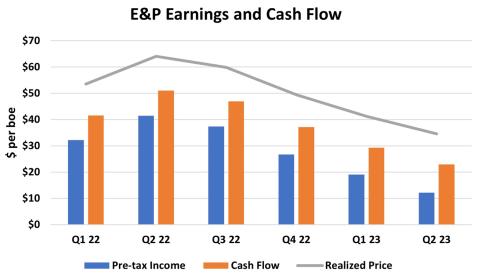

The historic results in Q1 2021 were not only a cause for celebration, but they also kicked off a stretch of extraordinary growth in returns triggered by soaring oil prices and stringent financial discipline. As shown in Figure 1 below, pre-tax income (blue bars) and cash flow (orange bars) peaked in Q2 2022 at $41.48/boe and $51.02/boe, respectively. But this golden age for E&Ps that we described in Camelot didn’t last. Realized prices (gray line) began to retreat in the second half of 2022, with the decline steepening in the first half of 2023, mostly because of plunging natural gas prices. The average WTI oil price in Q2 2023 was $73.75/bbl, down 32% from $108.78/bbl in Q2 2022, while the average Henry Hub gas price plummeted to $2.33/MMBtu, down 69% from $7.47/MMBtu over the same period. (For a table showing additional comparisons to previous quarters, click here.)

Figure 1. E&P Earnings and Cash Flow, Q1 2022-Q1 2023.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article