A few months back we introduced Whoville, the emerging NGL hub in a small corner of Pennsylvania and West Virginia. Now that hub is coming on like gangbusters. Between now and 2015 nearly 4.7 Bcf/d of additional cryogenic natural gas processing capacity is due to come online along with 500 Mb/d of fractionation capacity and 500 Mb/d of NGL pipeline takeaway capacity to support growing Utica and wet Marcellus production. As a result, NGL production from the Northeast is due to exceed 400 Mb/d by 2015, a six fold surge from EIA’s 63 Mb/d February production number. In today’s blog, we examine growing Northeast NGLs production.

Taking a step back for a moment to refresh your memory on Whoville and why it is significant, Whoville a.k.a Houville, is the center of an emerging Marcellus/Utica based NGL hub that we discussed back in December that will soon take its place among the largest North America NGL hubs. Like other NGL hubs, the fractionation facilities that have been and are being constructed in the Marcellus/Utica region are geographically concentrated. In this case it is not because they are sitting on a salt dome or bedded salt formation (like Mont Belvieu or Conway, the two primary existing U.S. NGL hubs) but because they are in the general vicinity of the most prolific wet gas plays and in close proximity to Northeast demand markets.

Getting NGLs to market is a two-step process; first the NGLs are extracted in bulk from wet gas at a gas processing plant. Gas processing happens, in general, near the producing basin as high btu content NGLs must be extracted from gas before it enters a long haul dry gas pipeline. The second step to getting NGLs to market is separating the bulk, “Y-grade” NGLs into the individual purity products (ethane, propane, butanes, natural gasoline) by running Y-grade through a fractionator. Fractionation capacity is ideally located near significant storage and demand.

Currently there is 1250 Mb/d of fractionation capacity in Mt. Belvieu, with another 400 Mb/d due to come online over the next 18 months or so. There is also significant fractionation capacity elsewhere on the Texas and Louisiana Gulf Coast. In total PADD 3 has 2600 Mb/d of operational fractionation capacity. In close proximity to Conway, KS, the other big U.S. NGL hub, which is in PADD 2, there is 550 Mb/d of operational fractionation capacity and no plans for further expansions at this time. If all the proposed projects come on as planned in the Northeast by the end of 2014, Houville will blast past Conway as the second largest Y-grade hub in the country. For more on Whoville see Whoville, the Big New NGL Hub in Marcellus/Utica?? (a.k.a, Houville)

Now back to our topic for today, growing Northeast NGLs production. For those of you not familiar with the Marcellus and Utica shale plays, below is a snapshot from the EIA’s Lower 48 States Shale Map. The entire map can be found by clicking here. Both the Marcellus and Utica Shales are part of the Appalachian Basin and span portions of OH, WV, PA and NY. The Utica shale sits just a few thousand feet below the Marcellus.

Source: EIA (Click to Enlarge)

The Marcellus is currently far more of a developed play than the emerging Utica, but based on dollars being invested; production from the Utica is also expected to be significant.

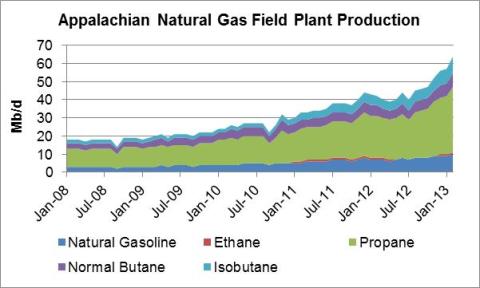

Historically, NGLs production from the Appalachian Basin has been very low, see the EIA chart below, but this is about to change. A lot of the traditional Appalachian production was dry gas, produced into low pressure systems. As natural gas prices fell over the last several years producers seeking higher rates of return have gone in search of liquids rich plays. And liquids they found in the wet portion of the Marcellus and the Utica.

Source: EIA (Click to Enlarge)

As was the case in the Williston Basin that we discussed a few weeks back in The Race is On and it Looks Like ONEOK – Bakken NGLs Production Growth, there has been almost zero ethane production to this point in the Northeast due to lack of local ethane demand. Gas processing plants in the region have historically run in a state of rejection, leaving the ethane in the natural gas stream. This too is about to change. As producers have moved to drilling in the liquids rich portion of these plays the btu content in dry gas pipelines is growing due to increasing ethane content. If the ethane is not produced as production continues to grow, btu limitations on dry gas pipelines in the region will be exceeded and production will have to be shut in. In the Northeast, you are close to the demand center so you don’t always have the opportunity to blend down high btu content gas in a long haul dry gas pipeline like you do in other areas of the country.

With economics continuing to support drilling in wet gas and oil plays to capture the additional value of propane, butanes and natural gasoline newer infrastructure is now required in the Northeast to support the production and fractionation of the growing NGL supply, including ethane. As a result midstream companies are bringing new infrastructure to the region and producers are very willing to partner with them to ensure their production gets to market.

There are several big midstream players in the Northeast supporting Appalachian Basin production growth including: MarkWest, Dominion, and Williams, with MarkWest being the biggest by far. Included in MarkWest’s May 8th 2013 first quarter earnings press release was an agreement with Antero Resources to expand the Sherwood processing complex (located in Doddridge county in WV) which would bring MarkWest’s total capacity in the Marcellus Shale to 3.2 Bcf/d by the end of 2014. While this is a significant amount of capacity in its own right, this is separate and distinct from MarkWest’s Utica processing capacity which is operated under MarkWest Utica EMG. By the end of 2013, MarkWest Utica is due to have over 800 MMcf/d of processing capacity online in Ohio to support growing Utica production.

As incremental processing capacity is coming online in the Northeast so is incremental fractionation capacity, allowing the individual NGL purity products (ethane, propane, butanes, natural gasoline) to be separated and sold in the NE markets. For additional insights into Northeast fractionation capacity and the development of a Northeast market hub see Whoville, the Big New NGL Hub in Marcellus/Utica?? (a.k.a, Houville)

As NGL production grows in the region as a result of the processing capacity additions, NGLs without local demand will need to leave the region to find a home. NGL pipeline takeaway capacity is being developed to move those products to market. Currently there is no local ethane demand in the NE, although several companies have proposed steam crackers for the region, most prominently Shell. Even if a new steam cracker is built in the region providing a local demand source for ethane, it will likely be 2019 or beyond before such a greenfield project could be operational. Until that point ethane will have to leave the region, mostly via pipeline.

Join Backstage Pass to Read Full Article