The latest North Dakota crude production estimates for July 2013 show a year on year increase of 200 Mb/d to a new record of 874 Mb/d. If you add Montana and South Dakota production (80 Mb/d) the Williston Basin is getting close to 1 MMb/d. After going through a famine of pipeline capacity in 2012, producers turned to rail to get their barrels to market. By the end of 2013 there will be 1.5 MMb/d of rail and pipeline takeaway capacity - more than enough to handle expanding output. Today we review the latest Bakken numbers.

Production

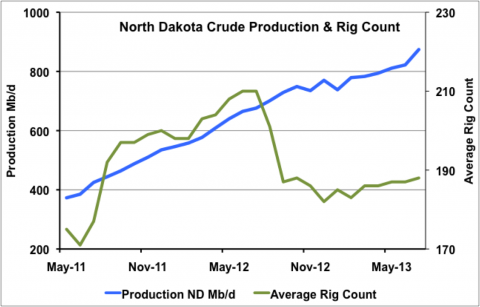

Last Friday (September 13, 2013) the North Dakota Pipeline Authority (NDPA) published the latest North Dakota Bakken oil production update. You can see the progression of Bakken production data on the chart below (blue line). The numbers have certainly outpaced earlier predictions. As we pointed out recently Bentek was projecting as recently as 2011 that North Dakota crude oil production would not reach 875 Mb/d until at least 2017 – four years from now (see Too Wrong For Too Long). Now output from North Dakota is on course to reach 1 MMb/d by the end of 2013. If you add recent production data from Montana (~75 Mb/d) and South Dakota (~5 Mb/d), which is only available through May 2013, the total US Williston Basin production is somewhere north of 950 Mb/d today.

Source: North Dakota Pipeline Authority (Click to Enlarge)

And as oil production soars in the Williston basin, drilling productivity has increased right along with it. The green line on the chart above is the average rig count. The data shows the rig count dropping off in September 2012 (187 rigs) and staying at that level since then even as production continues its upward trajectory. As we predicted in our 2013 New Year Prognostications, faster drill times, more efficient operations, multi-pad drilling and a variety of technological enhancements have resulted in increasing productivity from each rig in the US (see Top Ten Energy Prognostications for 2013). That translates into more barrels from each rig that is working. So fewer rigs are needed to generate the same number of new barrels.

Transport to Market

One area that has grabbed a lot of attention as Bakken production has increased from 200Mb/d back in January 2009 is transportation. North Dakota is blessed with lots of energy but not much demand. As a result supplies of crude oil need to be shipped relatively long distances to market. Early on in the play that was a problem because of a lack of pipeline capacity out of North Dakota. By 2011, if producers were lucky enough to secure pipeline space out of North Dakota, they ran into competition for space on larger pipelines into the Midwest market hub at Cushing, OK that were built to move Canadian crude to US markets. The result was congestion at the pipeline trading hubs of Clearbrook, MN and Guernsey, WY as crude coming out of the Bakken met southbound crude from Canada. Midwest refineries could not process the rapidly increasing supplies being delivered by pipeline and the crude stockpile at Cushing grew rapidly.

By 2012, Bakken producers had to swallow heavy discounts to the Midwest benchmark West Texas Intermediate (WTI) prices against which North Dakota prices are set. Discounts that on occasion ballooned out to $35/Bbl at Clearbrook, MN (see A Perfect Storm in the Bakken). The Bakken discounts to WTI felt even worse to Bakken producers because inland prices at Cushing were themselves discounted by an average of $18/Bbl to prices set at the coast by the international benchmark Brent. That disconnect in pricing was caused by the lack of pipeline capacity to deliver supplies from the Midwest to the Gulf Coast and other coastal refining centers. If Bakken producers could just get their crude to coastal refineries it would fetch as much as $40/Bbl more.

As we have relayed on many occasions, the build out of twenty crude rail-loading terminals in North Dakota during 2012 brought relief to Bakken producers (see From a Famine of Pipeline to a Feast of Rail) by facilitating a way to bypass the Midwest pipeline logjam. Although rail transportation is typically more expensive than pipelines, railroad shippers could deliver direct to coastal locations where prices were considerably higher – justifying the extra freight. The impact on Bakken takeaway routes to market was quite dramatic. Producers deserted the pipelines and headed to the rails. The chart below shows the monthly percentage estimates of transport options out of North Dakota for rail and pipeline since February 2012. The red line is the percentage of crude oil moving out of state on railroads and the blue line is the percentage travelling by pipeline.

Join Backstage Pass to Read Full Article