The ratio of Mont Belvieu ethane prices to the price of natural gas at the Henry Hub on a BTU equivalent basis has been below 100% since March. That means ethane is worth more as gas than as liquid ethane, which was bad enough for ethane producers. But two weeks ago the bottom dropped out from under that ratio, and it now wallows below 80%. At that level, every molecule of ethane being recovered would theoretically be worth far more selling it as gas anywhere in the U.S. So have ethane production numbers been falling? Nope. Ethane production for the past four months reported by EIA has averaged an all-time high. Ethane extraction economics are upside down but ethane production is increasing. Today we examine the reasons why ethane is being extracted even when the economics don’t seem to make sense.

Recently RBN has done several blogs covering ethane prices, the impact of prices on rejection, and the outlook for eventual petrochemical demand and exports that will provide homes for some, but not all of the ethane available for extraction. Too Much Of A Good Thing? included a list of sixteen petchem expansions and greenfield projects that will add 600 Mb/d of U.S. ethane demand by 2020. What’s Crackin examined the lofty margins being enjoyed by U.S. steam crackers running ethane and other light NGL feedstocks. In You Ain’t Seen Nethane Yet—More Ethane Rejection we reviewed ethane price trends, a supply/demand scenario looking forward to 2019, and catalogued both pipeline and waterborne export projects. In Ethane Exports Will Rise, But Will they Soar we went into the details of overseas export deals, including those involving INEOS, Borealis, SABIC, Reliance and others. Last week we looked at the possibility of ethane and natural gas moving into Caribbean power generation markets in Feeling Hot Hot Hot.

It's a REMIX! SCHOOL OF ENERGY CALGARY!

RBN's School of Energy has been reworked, restructured and reorganized to make the conference even better - more content, more models and more labs.

Calgary - March 30 - April 1, 2015

Over the next few years, this new ethane demand will help move the market back toward some kind of balance. But all the new investment begs the question – why is all this ethane being recovered in the first place? Two years ago we did a deep dive into ethane rejection economics in Big Time Ethane Rejection In The Shale Gas World. If you want all the math, go back and look at the model included with that blog series. But all you really need to know is summarized in Figures #1 and #2 below, based on recent price relationships.

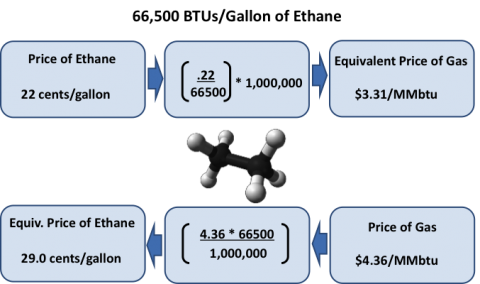

Figure #1 – Ethane to Gas Price Conversions

Figure #1 depicts the price conversions from ethane to gas and vice versa. In this calculation we’ll use an ethane heat content of 66,500 BTU per gallon. The top boxes in Figure #1 show the conversion of the ethane price per gallon to dollars per MMbtu. So if the price of ethane is 22 cents, divide by 66,500 and multiply by 1,000,000 to yield an equivalent gas price of $3.31/MMbtu. That is $1.05/MMbtu cheaper than gas which settled yesterday at $4.36/MMbtu. Expressed as a ratio, ethane is 76% of gas on a BTU basis (3.31 / 4.36 = .76) Backstage Pass subscribers see Ethane-to-Gas ratio Spotcheck graph.

Join Backstage Pass to Read Full Article