Offshore platforms facilitate Gulf of Mexico (GOM) production, but when their useful life is over they are typically decommissioned and dismantled to be sold as scrap or converted into an artificial reef. Not always, though. In certain cases, inactive rigs can be refurbished and used in new projects — a potentially inviting possibility, especially with GOM production expected to rise and drillers under pressure to keep costs down. In today’s RBN blog, we will examine the challenges (and potential benefits) of reusing an inactive platform and look at plans by LLOG Exploration to refurbish an existing facility for its upcoming Salamanca development, the first such project in a decade.

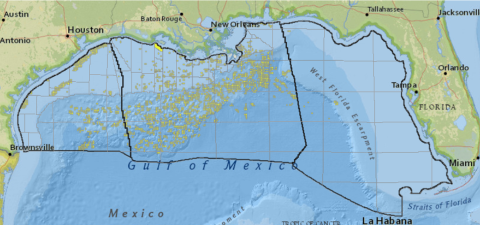

The majority of U.S. offshore E&P business occurs in the GOM, which generates about 14% of U.S. crude oil output. The federal government regulates most of that activity along the Outer Continental Shelf (OCS). Its oversight begins about 3.5 miles off the coast of Alabama, Louisiana and Mississippi; for Texas and Florida, its jurisdiction starts about 10 miles offshore (see black line hugging the coast in Figure 1 below). The Bureau of Ocean Energy Management (BOEM) and the Bureau of Safety and Environmental Enforcement (BSEE) are tasked with managing GOM activity, from overseeing lease sales to expanding production areas to issuing rules on what E&Ps must do with wells, platforms and associated infrastructure once their projects have run their course. (Note: Yellow dots in Figure 1 indicate active leases.)

Figure 1. Gulf of Mexico Offshore Production Areas. Source: Bureau of Ocean Energy Management

In Riders On The Storm, we noted that GOM drillers have nearly tripled the area’s oil output since the Energy Information Administration (EIA) started tracking data in the 1980s — production peaked at just under 2 MMb/d in 2019 and is expected to average 1.9 MMb/d in 2025, according to the EIA. There have been periods when offshore supply took a hit, like the Great Recession, the Macondo disaster and COVID-19, when weak markets challenged producers. However, the trendline shows supply is growing, with discoveries in progressively deeper waters more than offsetting receding supply in shallower coastal areas. As we have detailed in previous blogs, the deeper waters are primarily where there are still resources to discover; shallower areas are easier to develop but have limited potential after years of development activity. Deepwater production accounts for more than 90% of total GOM output. Also note that virtually all GOM production comes from areas not included in former President Biden’s decision to permanently ban new oil and gas drilling from 625 million acres of coastal waters — see Separate Ways (Worlds Apart) — an order that President Trump seeks to reverse.

Join Backstage Pass to Read Full Article