The cacophony of Black Friday promotions may make us all wonder if the “giving thanks” part of the fourth Thursday of November has been subsumed by rampant consumerism. But we suspect that E&P executives sat down to more traditional celebrations of gratitude as the upstream part of the oil and gas industry rebounded nicely in Q3 from five consecutive periods of declining profits and cash flows. In today’s RBN blog, we analyze Q3 2023 E&P earnings and cash flows and provide some perspective on the past and future profitability of U.S. oil and gas producers.

Over the past three years we’ve chronicled the remarkable recovery of the U.S. E&P sector from its dramatic price crash at the onset of the pandemic in early 2020. The recovery was fueled by rising commodity prices and the strategic transformation to a fiscally conservative model that prioritizes cash flow and shareholder returns. Producers’ earnings reached historic highs in Q2 2022, but steadily declined in subsequent quarters with oil and natural gas prices. As we explained in Bottoms Up, results reached a recent nadir in Q2 2023. Then, the 40 E&P companies we monitor reported pre-tax operating earnings of $12.18/boe and cash flow of $22.95/boe, down 71% and 55%, respectively, from the high five quarters ago.

However, as we also pointed out in that blog, the health of the industry and its future outlook were far from dire. The Q2 2023 results matched earnings in Q1 2021, when the E&P sector staged a dramatic recovery from $84 billion in losses in 2020 and posted the highest pre-tax earnings in the previous decade. Not only were Q2 2023 results historically strong, but we also noted that rising commodity prices suggested an improving outlook for the second half of this year. When Q3 ended on September 30, average WTI oil prices had rebounded to $82/bbl — 11% higher than the previous quarter — and Henry Hub natural gas prices were up about 15% to $2.66/MMBtu, which solidified expectations about a turnaround in results.

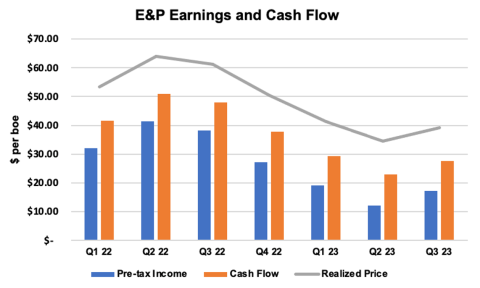

The rebound in earnings and cash flow for our 40 E&Ps actually surpassed most projections. Earnings for the group increased 42% over Q2 2023 to $23.7 billion, or $17.16/boe (blue bar to far right in Figure 1). Cash flow amounted to $38.1 billion ($27.59/boe; orange bar to far right), 22% better than the prior quarter. Both gains significantly exceeded the 13% rise in average realized prices (gray line) to $39.16/boe. Thirty-nine of the 40 companies in our study universe posted a profit in Q3 2023, with only EQT Corp. reporting a pre-tax operating loss. Earnings for the Gas-Weighted peer group tripled on the recovery in realizations while profits for the Oil-Weighted and Diversified producers rose 48% and 29%, respectively.

Figure 1. E&P Earnings and Cash Flow, Q1 2022-Q3 2023.

Source: Oil & Gas Financial Analytics, LLC

Join Backstage Pass to Read Full Article